Phoenix Rising: De Novo Bank Formation?

According to the Federal Deposit Insurance Corporation (“FDIC”), from 2000 to 2008 there were 1,042 de novo community banks newly chartered in the United States. From 2011-2017, the FDIC received only 30 de novo applications for deposit insurance. Of those 30 applications received, six have been approved, 10 withdrawn and 14 remain outstanding. At year end 2017, the number of U.S. banks fell below 5,700 – a number the industry hasn’t seen since the 19th century. Recently, the FDIC indicated that it has warmed to the idea of accepting de novo bank applications. Now may be the time for interested investors to assess the possibility of entering the community bank industry.

Historical Barriers to Increased De Novo Activity

1. Cyclicality. Historically, de novo formation has been cyclical. When the economy is in recession, de novo activity decreases. Thus, while the U.S. economy’s growth was sluggish for a period of time following the recession, investors’ interest in pursuing de novo charters remained sluggish. This reason helps to explain why, at least initially, de novo activity was sluggish following the 2008-2009 recession.

2. Interest Rates. From 2009 through 2016, low interest rates and narrow net interest margins kept bank profitability ratios (e.g., ROA and ROE) well below pre-crisis levels. As interest rates have remained low for an extended period of time, de novo activity can be seen to have remained stagnant during that same period. With low rates, banking simply has been very competitive, and this in turn has squeezed profits. With rising interest rates, however, interest in de novo formation is also likely to increase.

3. Regulatory Burden and Criticism. During the financial crisis, de novo banks experienced a failure rate of more than twice that of smaller established community banks. As a result of those failures, the FDIC was heavily and publicly criticized for approving such a large number of de novo bank formations. Consequently, during the years immediately following the financial crisis, the FDIC became hesitant to approve de novo bank applications. In addition, increased regulatory scrutiny and heightened compliance requirements for the industry generally took shape to slow de novo bank formations. Regulators required higher capital ratios and placed increasing emphasis on compliance with Bank Secrecy Act/anti-money laundering requirements, implementation of enterprise risk management systems and effective corporate governance.

The Path to Regulatory Approval

Over the past two years, the FDIC has continually signaled to the market that it has warmed to the idea of accepting de novo bank applications for FDIC insurance. In a show of support for de novo formation, the FDIC has taken the following actions to promote de novo applications during the past two years:

On April 6, 2016, the FDIC rescinded FIL-50-2009, Enhanced Supervisory Procedures for Newly Insured FDIC-Supervised Depository Institutions. This action lessened the regulatory burden on de novo banks by rescinding a 2009 FIL which had extended the heightened examination, capital and other requirements for de novo banks from three years to seven years. As a result, the heightened standards are only applicable to de novos for the first three years of operation.

With the rescission of FIL-50-2009, the FDIC reverted to its historical guidance as found in the FDIC Statement of Policy on Applications for Deposit Insurance (“Policy”). Under this Policy, for a period of three years after approval, newly insured de novo community banks must do the following:

- 1. maintain capital accounts sufficient to provide a Tier 1 capital to assets leverage ratio of 8.0%, at a minimum; and

- 2. report to its primary federal regulator any significant deviation from the de novo’s business plan prior to any such deviation.

In addition to these Policy requirements, a de novo community bank is also subject to more frequent and broader scope examinations, generally every 6 to 12 months. Annual examination intervals for more established community banks may be extended up to 18 months.

Also in April 2016, the FDIC supplemented the Questions and Answers to the FDIC Statement of Policy on Applications for Deposit Insurance (“Q&As”) to address multiple issues related to applicant-submitted business plans. The FDIC’s stated purpose was to provide clarity as to what is expected in a de novo bank’s submitted business plan. Although there is not a specific blueprint for any proposed business plan, other than those items required to be addressed in the application, the FDIC has provided a level of increased transparency by identifying items that should be considered and addressed in an applicant’s submitted business plan.

Since April 2016, the FDIC has also issued additional information to assist interested parties in forming de novo banks:

- Applying for Deposit Insurance: A Handbook for Organizers of De Novo Institutions (April 2017)

- “De Novo Banks: Economic Trends and Supervisory Framework,” Summer 2016 – Supervisory Insights journal (August 2016)

The fact that the FDIC is even addressing the subject of de novo charters is a sure sign of a more open regulatory environment.

Reasons for Establishing a De Novo Bank

In our experience, over the past year there has been renewed interest in establishing de novo banks. The reasons for renewed interest include, but are not limited to, the following:

- Increased profitability in the industry and gains realized through acquisition activity

- Consolidation of a market through acquisitions which leads to an opportunity for a new bank to serve customers

- Opportunity to serve a distinct business or ethnic niche market

- Customer service-centered growth opportunities

- Low failure rates compared to other industries

Common Characteristics of Newly Filed De Novo Bank Applications

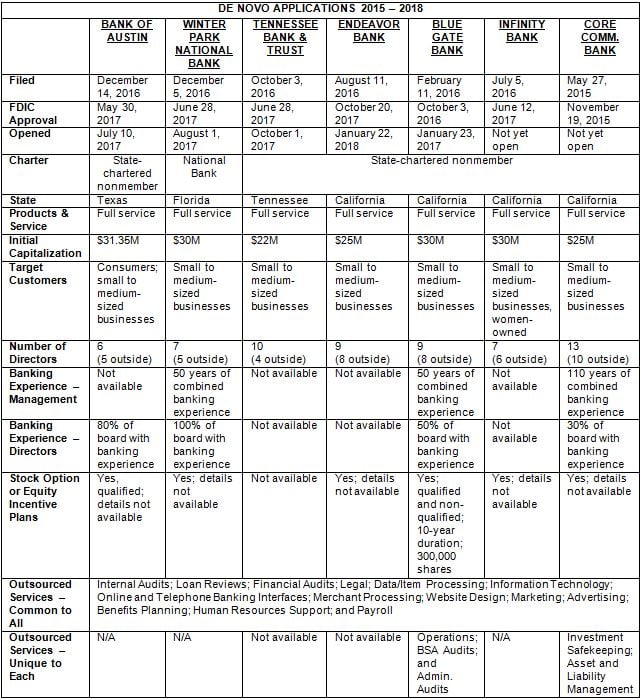

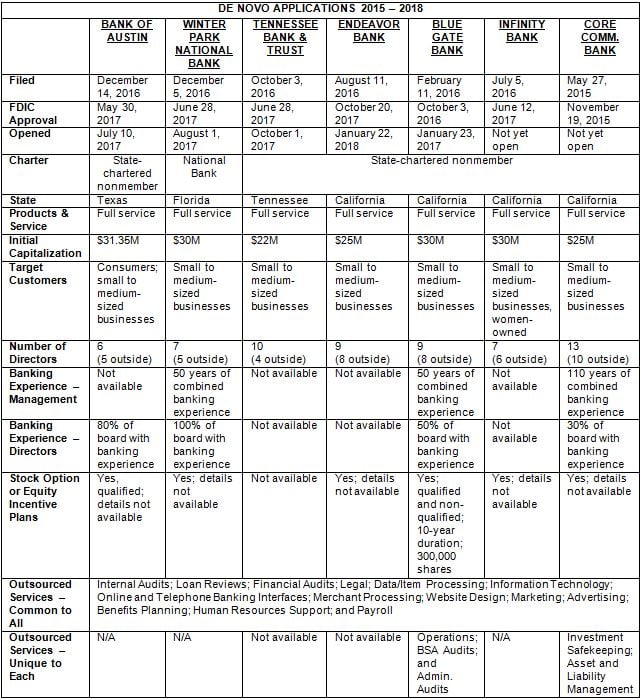

As evidence of a more hospitable landscape for de novo bank formation, the marketplace has seen a growing uptick in de novo activity. Below are some of the common characteristics of the de novo applications filed during the last two years.

As the information set forth above indicates, there are consistent and common features to each of the above applications. While every application is unique to the prospective institution, one can glean a hint of what regulators expect to see in any de novo bank application. Below is a brief market summary of these recently filed applications:

- Timeframe for Approval. Although the processing time for any de novo application is unique to the prospective institution, the average processing time from submission to receipt of organizational approval ranges from six to nine months.

- Average Initial Capitalization. The average initial capitalization (shareholder equity) for these institutions is $25–30 million. Some might clearly remember the pre-recession days when investors could form a de novo bank with an initial capitalization of $10–15 million. Those days are long gone. Prospective investors will need to locate and raise a significant amount of capital.

- Management’s Experience. De novo bank applicants should take note that regulators expect to see prospective management officials with significant banking experience. In particular, this is true when selecting the de novo bank’s chief executive officer and chief credit officer. A de novo community bank application with an executive management team lacking strong experience in banking is a nonstarter. In addition, regulators are insistent upon the de novo bank’s board of directors having a significant level of banking experience as well. Of course, not every member of the board of directors is expected to have significant banking experience, but the information above tends to show at least one-third of the board of directors should have banking experience.

- Executive and Employee Compensation. As in any business, executive and employee compensation is front and center. The de novo bank applications indicate that stock option and equity incentive plans are standard means of compensation. As de novo banks are typically cash-strapped during the first three years, stock option plans provide both a means of incentivizing and retaining key employees in a cost effective manner. The FDIC has historically been focused on this point, and it carefully reviews any stock option plan in accordance with enumerated guiding factors. In any stock option plan, the structure should encourage the continued involvement of any grantees and serve as an incentive for the successful operation of the de novo institution. Further, stock option plans should contain no feature that would encourage speculative or high-risk activities or serve to impede the sale of additional stock.

- Locations of Newly Established De Novos. Of the above-listed de novo applications, a pattern is evident. De novo activity is increasing in markets seeing significant growth (e.g., California, Texas, Tennessee and Florida). These markets have seen steady growth, rising commercial investment and increased M&A activity during the last seven years. Consequently, these de novo applications have been filed in stabilized markets with the commercial capacity to attract and sustain de novo banks.

- Outsourcing of Compliance and Back Office Functions. As compliance costs have skyrocketed, de novo bank applicants have increasingly sought to outsource activities that have traditionally been handled in-house, such as compliance functions. The types of outsourced activities appear to be consistent in each of the recently filed applications, and reflect the general trends in the industry.

Conclusion

As the FDIC has warmed to the idea of supporting de novo bank applications, it may be the time to evaluate investment opportunities in the community banking space through the formation of a de novo institution. Although forming a de novo institution still presents certain challenges, it is clear that the current environment is much more conducive to de novo formation than at any time since the financial crisis.

To view the full text of the FDIC’s Summer 2016 – Supervisory Insights Journal, click here.

To view the FDIC’s Statement of Policy on Applications for Deposit Insurance, click here.

To view FIL 24-2016, Supplemental Guidance Related to the FDIC Statement of Policy on Applications for Deposit Insurance, click here.

To view the full text of the now rescinded FIL-50-2009, Enhanced Supervisory Procedures for Newly Insured FDIC-Supervised Depository Institutions, click here.

For more information about the FDIC de novo application process and what it could mean for your institution, please contact James M. Kane at +1 (312) 609 7533, Daniel C. McKay, II at +1 (312) 609 7762, James W. Morrissey at +1 (312) 609 7717, Jennifer Durham King at +1 (312) 609 7835, Juan M. Arciniegas at +1 (312) 609 7655, Lisa M. Simonetti at +1 (424) 204 7738, Mark C. Svalina at +1 (312) 609 7741 or your Vedder Price attorney.

Vedder Thinking | Articles Phoenix Rising: De Novo Bank Formation?

Newsletter

March 23, 2018

According to the Federal Deposit Insurance Corporation (“FDIC”), from 2000 to 2008 there were 1,042 de novo community banks newly chartered in the United States. From 2011-2017, the FDIC received only 30 de novo applications for deposit insurance. Of those 30 applications received, six have been approved, 10 withdrawn and 14 remain outstanding. At year end 2017, the number of U.S. banks fell below 5,700 – a number the industry hasn’t seen since the 19th century. Recently, the FDIC indicated that it has warmed to the idea of accepting de novo bank applications. Now may be the time for interested investors to assess the possibility of entering the community bank industry.

Historical Barriers to Increased De Novo Activity

1. Cyclicality. Historically, de novo formation has been cyclical. When the economy is in recession, de novo activity decreases. Thus, while the U.S. economy’s growth was sluggish for a period of time following the recession, investors’ interest in pursuing de novo charters remained sluggish. This reason helps to explain why, at least initially, de novo activity was sluggish following the 2008-2009 recession.

2. Interest Rates. From 2009 through 2016, low interest rates and narrow net interest margins kept bank profitability ratios (e.g., ROA and ROE) well below pre-crisis levels. As interest rates have remained low for an extended period of time, de novo activity can be seen to have remained stagnant during that same period. With low rates, banking simply has been very competitive, and this in turn has squeezed profits. With rising interest rates, however, interest in de novo formation is also likely to increase.

3. Regulatory Burden and Criticism. During the financial crisis, de novo banks experienced a failure rate of more than twice that of smaller established community banks. As a result of those failures, the FDIC was heavily and publicly criticized for approving such a large number of de novo bank formations. Consequently, during the years immediately following the financial crisis, the FDIC became hesitant to approve de novo bank applications. In addition, increased regulatory scrutiny and heightened compliance requirements for the industry generally took shape to slow de novo bank formations. Regulators required higher capital ratios and placed increasing emphasis on compliance with Bank Secrecy Act/anti-money laundering requirements, implementation of enterprise risk management systems and effective corporate governance.

The Path to Regulatory Approval

Over the past two years, the FDIC has continually signaled to the market that it has warmed to the idea of accepting de novo bank applications for FDIC insurance. In a show of support for de novo formation, the FDIC has taken the following actions to promote de novo applications during the past two years:

On April 6, 2016, the FDIC rescinded FIL-50-2009, Enhanced Supervisory Procedures for Newly Insured FDIC-Supervised Depository Institutions. This action lessened the regulatory burden on de novo banks by rescinding a 2009 FIL which had extended the heightened examination, capital and other requirements for de novo banks from three years to seven years. As a result, the heightened standards are only applicable to de novos for the first three years of operation.

With the rescission of FIL-50-2009, the FDIC reverted to its historical guidance as found in the FDIC Statement of Policy on Applications for Deposit Insurance (“Policy”). Under this Policy, for a period of three years after approval, newly insured de novo community banks must do the following:

- 1. maintain capital accounts sufficient to provide a Tier 1 capital to assets leverage ratio of 8.0%, at a minimum; and

- 2. report to its primary federal regulator any significant deviation from the de novo’s business plan prior to any such deviation.

In addition to these Policy requirements, a de novo community bank is also subject to more frequent and broader scope examinations, generally every 6 to 12 months. Annual examination intervals for more established community banks may be extended up to 18 months.

Also in April 2016, the FDIC supplemented the Questions and Answers to the FDIC Statement of Policy on Applications for Deposit Insurance (“Q&As”) to address multiple issues related to applicant-submitted business plans. The FDIC’s stated purpose was to provide clarity as to what is expected in a de novo bank’s submitted business plan. Although there is not a specific blueprint for any proposed business plan, other than those items required to be addressed in the application, the FDIC has provided a level of increased transparency by identifying items that should be considered and addressed in an applicant’s submitted business plan.

Since April 2016, the FDIC has also issued additional information to assist interested parties in forming de novo banks:

- Applying for Deposit Insurance: A Handbook for Organizers of De Novo Institutions (April 2017)

- “De Novo Banks: Economic Trends and Supervisory Framework,” Summer 2016 – Supervisory Insights journal (August 2016)

The fact that the FDIC is even addressing the subject of de novo charters is a sure sign of a more open regulatory environment.

Reasons for Establishing a De Novo Bank

In our experience, over the past year there has been renewed interest in establishing de novo banks. The reasons for renewed interest include, but are not limited to, the following:

- Increased profitability in the industry and gains realized through acquisition activity

- Consolidation of a market through acquisitions which leads to an opportunity for a new bank to serve customers

- Opportunity to serve a distinct business or ethnic niche market

- Customer service-centered growth opportunities

- Low failure rates compared to other industries

Common Characteristics of Newly Filed De Novo Bank Applications

As evidence of a more hospitable landscape for de novo bank formation, the marketplace has seen a growing uptick in de novo activity. Below are some of the common characteristics of the de novo applications filed during the last two years.

As the information set forth above indicates, there are consistent and common features to each of the above applications. While every application is unique to the prospective institution, one can glean a hint of what regulators expect to see in any de novo bank application. Below is a brief market summary of these recently filed applications:

- Timeframe for Approval. Although the processing time for any de novo application is unique to the prospective institution, the average processing time from submission to receipt of organizational approval ranges from six to nine months.

- Average Initial Capitalization. The average initial capitalization (shareholder equity) for these institutions is $25–30 million. Some might clearly remember the pre-recession days when investors could form a de novo bank with an initial capitalization of $10–15 million. Those days are long gone. Prospective investors will need to locate and raise a significant amount of capital.

- Management’s Experience. De novo bank applicants should take note that regulators expect to see prospective management officials with significant banking experience. In particular, this is true when selecting the de novo bank’s chief executive officer and chief credit officer. A de novo community bank application with an executive management team lacking strong experience in banking is a nonstarter. In addition, regulators are insistent upon the de novo bank’s board of directors having a significant level of banking experience as well. Of course, not every member of the board of directors is expected to have significant banking experience, but the information above tends to show at least one-third of the board of directors should have banking experience.

- Executive and Employee Compensation. As in any business, executive and employee compensation is front and center. The de novo bank applications indicate that stock option and equity incentive plans are standard means of compensation. As de novo banks are typically cash-strapped during the first three years, stock option plans provide both a means of incentivizing and retaining key employees in a cost effective manner. The FDIC has historically been focused on this point, and it carefully reviews any stock option plan in accordance with enumerated guiding factors. In any stock option plan, the structure should encourage the continued involvement of any grantees and serve as an incentive for the successful operation of the de novo institution. Further, stock option plans should contain no feature that would encourage speculative or high-risk activities or serve to impede the sale of additional stock.

- Locations of Newly Established De Novos. Of the above-listed de novo applications, a pattern is evident. De novo activity is increasing in markets seeing significant growth (e.g., California, Texas, Tennessee and Florida). These markets have seen steady growth, rising commercial investment and increased M&A activity during the last seven years. Consequently, these de novo applications have been filed in stabilized markets with the commercial capacity to attract and sustain de novo banks.

- Outsourcing of Compliance and Back Office Functions. As compliance costs have skyrocketed, de novo bank applicants have increasingly sought to outsource activities that have traditionally been handled in-house, such as compliance functions. The types of outsourced activities appear to be consistent in each of the recently filed applications, and reflect the general trends in the industry.

Conclusion

As the FDIC has warmed to the idea of supporting de novo bank applications, it may be the time to evaluate investment opportunities in the community banking space through the formation of a de novo institution. Although forming a de novo institution still presents certain challenges, it is clear that the current environment is much more conducive to de novo formation than at any time since the financial crisis.

To view the full text of the FDIC’s Summer 2016 – Supervisory Insights Journal, click here.

To view the FDIC’s Statement of Policy on Applications for Deposit Insurance, click here.

To view FIL 24-2016, Supplemental Guidance Related to the FDIC Statement of Policy on Applications for Deposit Insurance, click here.

To view the full text of the now rescinded FIL-50-2009, Enhanced Supervisory Procedures for Newly Insured FDIC-Supervised Depository Institutions, click here.

For more information about the FDIC de novo application process and what it could mean for your institution, please contact James M. Kane at +1 (312) 609 7533, Daniel C. McKay, II at +1 (312) 609 7762, James W. Morrissey at +1 (312) 609 7717, Jennifer Durham King at +1 (312) 609 7835, Juan M. Arciniegas at +1 (312) 609 7655, Lisa M. Simonetti at +1 (424) 204 7738, Mark C. Svalina at +1 (312) 609 7741 or your Vedder Price attorney.