Appealing FDIC Material Supervisory Determinations: Is It Worth It?

Recently, the Federal Deposit Insurance Corporation (the “FDIC”) announced that it was seeking comments on proposed modifications (the “Proposed Amendments”) to its Guidelines for Appeals of Material Supervisory Determinations (the “Guidelines”). The stated purpose of the Proposed Amendments is to provide banks with greater avenues of redress with respect to FDIC supervisory determinations and to achieve greater consistency in the FDIC appeals process with other federal banking regulators. Under the Proposed Amendments, banks would be permitted to appeal (i) determinations regarding a bank’s compliance with an existing formal enforcement action and (ii) decisions to initiate an informal enforcement action.

Background

Under Section 309 of the Riegle Community Development and Regulatory Improvement Act of 1994 (the “Riegle Act”), the FDIC and the other federal bank regulators are required to establish and maintain an independent intra-agency appellate process that permits banks to seek review of material supervisory determinations. In 1995, the FDIC established its Supervision Appeals Review Committee (“SARC”) to oversee the appellate process governing material supervisory determinations.

Over the years, the FDIC has come to define the term “material supervisory determinations” to include determinations relating to the following:

- examination ratings;

- the adequacy of loan loss reserve provisions;

- classifications of loans that are significant to an institution; and

- any other determinations not specified in the Riegle Act that may affect the capital, earnings, operating flexibility or capital category for prompt corrective-action purposes of an institution or that otherwise affect the nature and level of supervisory oversight accorded to a bank.

The FDIC has been clear that appealable material supervisory determinations do not include:

- formal enforcement-related actions and decisions, including determinations and the underlying facts and circumstances that form the basis of a recommended or pending formal enforcement action;

- decisions to take prompt corrective action pursuant to Section 38 of the Federal Deposit Insurance Act;

- determinations for which other appeals procedures exist (such as determinations relating to deposit insurance assessment risk classifications and payment calculations); and

- decisions to appoint a conservator or a receiver for an insured depository institution.

Proposed Amendments

Under the Proposed Amendments, the FDIC has announced its intention to make the following modifications to the Guidelines:

- Compliance with Existing Enforcement Actions. The FDIC proposes to allow determinations regarding a bank’s compliance with an existing formal enforcement action to be appealed; however, if the FDIC determines that noncompliance with an existing enforcement action requires an additional enforcement action, the proposed new enforcement action would not be appealable. This modification provides banks the ability to seek an independent legal review of supervisory determinations.

- Initiation of an Informal Enforcement Action. The Proposed Amendments would remove from the list of determinations that are not appealable “decisions to initiate an informal enforcement action” (e.g., a Memorandum of Understanding).

- Formal Enforcement-Related Action or Decision. Under the current Guidelines, formal enforcement-related actions and decisions, including determinations and the underlying facts and circumstances that form the basis of the action or decision, are unappealable. The Proposed Amendments clarify that a formal enforcement-related action or decision commences, and therefore becomes unappealable, when the FDIC initiates a formal investigation or provides written notice to the bank of a recommended or proposed formal enforcement action, including written notice of a referral to the Attorney General pursuant to the Equal Credit Opportunity Act (“ECOA”) or a notice to the Secretary of Housing and Urban Development for violations of the ECOA or the Fair Housing Act.

State of the Appeals Process

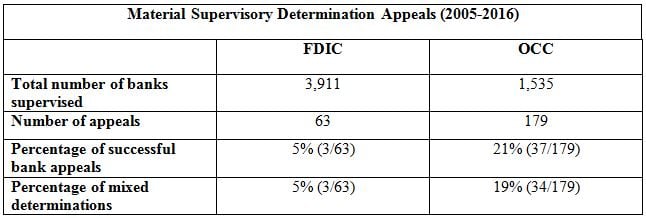

The annual reports issued separately by both the Office of the Comptroller of the Currency (the “OCC”) and the FDIC provide some insight into the current state of the appeals process.

As these statistics indicate, the appeals process is not frequently used. This seems to be especially true of the FDIC, which supervises significantly more financial institutions than the OCC but receives significantly fewer appeals. However, one should be cautious about drawing conclusions. Each agency states that examination disagreements are best settled informally. In making a determination to file a formal appeal, banks typically weigh the probability of success, costs associated with the appeal and timeframe for resolution. Rather than indicating an underutilization of the appeals process, these statistics may actually show that banks, when weighing the pros/cons of a formal appeal including the distinctly low probability of success, opt to resolve the matters informally.

Conclusion

The stated purpose of the Proposed Amendments is to provide banks with a greater number of avenues of redress with respect to FDIC supervisory determinations. However, the numbers do not lie. The formal appeals process is seldom used. In analyzing the numbers, one should be careful about attaching a meaning to the historical data. As informal appeals are not a part of the reported data, the true success rate for appeals may be understated. In light of this historical data, which shows that banks are unlikely to file formal appeals, and are highly unsuccessful when banks do file, a prudent bank is more likely to save its challenges for the big issues and for instances in which it has a better than average chance of winning.

To view the full text of the FDIC’s Proposed Amendments, click here.

For more information about the Proposed Amendments, please contact James M. Kane at +1 (312) 609 7533, Daniel C. McKay, II at +1 (312) 609 7762, James W. Morrissey at +1 (312) 609 7717, Jennifer Durham King at +1 (312) 609 7835, Juan M. Arciniegas at +1 (312) 609 7655, Daniel O’Rourke at +1 (312) 609 7669, Lisa M. Simonetti at +1 (424) 204 7738, Mark C. Svalina at +1 (312) 609 7741 or your Vedder Price attorney.

Vedder Thinking | Articles Appealing FDIC Material Supervisory Determinations: Is It Worth It?

Newsletter

August 2016

Recently, the Federal Deposit Insurance Corporation (the “FDIC”) announced that it was seeking comments on proposed modifications (the “Proposed Amendments”) to its Guidelines for Appeals of Material Supervisory Determinations (the “Guidelines”). The stated purpose of the Proposed Amendments is to provide banks with greater avenues of redress with respect to FDIC supervisory determinations and to achieve greater consistency in the FDIC appeals process with other federal banking regulators. Under the Proposed Amendments, banks would be permitted to appeal (i) determinations regarding a bank’s compliance with an existing formal enforcement action and (ii) decisions to initiate an informal enforcement action.

Background

Under Section 309 of the Riegle Community Development and Regulatory Improvement Act of 1994 (the “Riegle Act”), the FDIC and the other federal bank regulators are required to establish and maintain an independent intra-agency appellate process that permits banks to seek review of material supervisory determinations. In 1995, the FDIC established its Supervision Appeals Review Committee (“SARC”) to oversee the appellate process governing material supervisory determinations.

Over the years, the FDIC has come to define the term “material supervisory determinations” to include determinations relating to the following:

- examination ratings;

- the adequacy of loan loss reserve provisions;

- classifications of loans that are significant to an institution; and

- any other determinations not specified in the Riegle Act that may affect the capital, earnings, operating flexibility or capital category for prompt corrective-action purposes of an institution or that otherwise affect the nature and level of supervisory oversight accorded to a bank.

The FDIC has been clear that appealable material supervisory determinations do not include:

- formal enforcement-related actions and decisions, including determinations and the underlying facts and circumstances that form the basis of a recommended or pending formal enforcement action;

- decisions to take prompt corrective action pursuant to Section 38 of the Federal Deposit Insurance Act;

- determinations for which other appeals procedures exist (such as determinations relating to deposit insurance assessment risk classifications and payment calculations); and

- decisions to appoint a conservator or a receiver for an insured depository institution.

Proposed Amendments

Under the Proposed Amendments, the FDIC has announced its intention to make the following modifications to the Guidelines:

- Compliance with Existing Enforcement Actions. The FDIC proposes to allow determinations regarding a bank’s compliance with an existing formal enforcement action to be appealed; however, if the FDIC determines that noncompliance with an existing enforcement action requires an additional enforcement action, the proposed new enforcement action would not be appealable. This modification provides banks the ability to seek an independent legal review of supervisory determinations.

- Initiation of an Informal Enforcement Action. The Proposed Amendments would remove from the list of determinations that are not appealable “decisions to initiate an informal enforcement action” (e.g., a Memorandum of Understanding).

- Formal Enforcement-Related Action or Decision. Under the current Guidelines, formal enforcement-related actions and decisions, including determinations and the underlying facts and circumstances that form the basis of the action or decision, are unappealable. The Proposed Amendments clarify that a formal enforcement-related action or decision commences, and therefore becomes unappealable, when the FDIC initiates a formal investigation or provides written notice to the bank of a recommended or proposed formal enforcement action, including written notice of a referral to the Attorney General pursuant to the Equal Credit Opportunity Act (“ECOA”) or a notice to the Secretary of Housing and Urban Development for violations of the ECOA or the Fair Housing Act.

State of the Appeals Process

The annual reports issued separately by both the Office of the Comptroller of the Currency (the “OCC”) and the FDIC provide some insight into the current state of the appeals process.

As these statistics indicate, the appeals process is not frequently used. This seems to be especially true of the FDIC, which supervises significantly more financial institutions than the OCC but receives significantly fewer appeals. However, one should be cautious about drawing conclusions. Each agency states that examination disagreements are best settled informally. In making a determination to file a formal appeal, banks typically weigh the probability of success, costs associated with the appeal and timeframe for resolution. Rather than indicating an underutilization of the appeals process, these statistics may actually show that banks, when weighing the pros/cons of a formal appeal including the distinctly low probability of success, opt to resolve the matters informally.

Conclusion

The stated purpose of the Proposed Amendments is to provide banks with a greater number of avenues of redress with respect to FDIC supervisory determinations. However, the numbers do not lie. The formal appeals process is seldom used. In analyzing the numbers, one should be careful about attaching a meaning to the historical data. As informal appeals are not a part of the reported data, the true success rate for appeals may be understated. In light of this historical data, which shows that banks are unlikely to file formal appeals, and are highly unsuccessful when banks do file, a prudent bank is more likely to save its challenges for the big issues and for instances in which it has a better than average chance of winning.

To view the full text of the FDIC’s Proposed Amendments, click here.

For more information about the Proposed Amendments, please contact James M. Kane at +1 (312) 609 7533, Daniel C. McKay, II at +1 (312) 609 7762, James W. Morrissey at +1 (312) 609 7717, Jennifer Durham King at +1 (312) 609 7835, Juan M. Arciniegas at +1 (312) 609 7655, Daniel O’Rourke at +1 (312) 609 7669, Lisa M. Simonetti at +1 (424) 204 7738, Mark C. Svalina at +1 (312) 609 7741 or your Vedder Price attorney.