When the IRS Receives an Additional $80 Billion, Who Will Pay the Price?

I. BACKGROUND

The Inflation Reduction Act of 2022 (the “IRA”) provided an $80 billion budget increase for the Internal Revenue Service (the “IRS”) and for non-IRS tax functions.1 How will the IRS spend these additional funds, and who is expected to win and who is likely to suffer from this congressional largess? Although the answers are not certain, a look at how this amount is allocated in the IRA and the announcements of the Department of the Treasury (the “Treasury”) and the IRS give us a pretty good idea.

Approximately $79 billion of this windfall is allocated to the IRS for enforcement, taxpayer services, operations support and business system modernization with $45.6 billion appropriated for tax enforcement activities. The IRS is expected to use these additional enforcement resources to reduce the “tax gap” (the difference between the true tax liability for a taxable year and the amount that is actually paid to the government on a timely basis) through targeted enforcement actions. Some observations regarding these efforts are as follows:

- The estimated annual tax gap that is attributed to the major filing categories—individuals, corporate, employment and estates—is estimated to be $500 to 600 billion depending on the source.2 Thus, audit rates for these taxpayers are expected to increase.

- Enforcement activities are likely to be concentrated at the top of the income spectrum ($400,000 or more, the “high-end”).

- The additional funding is expected to help the IRS overcome the complexity that was shielding high-end returns in certain of these categories from audit scrutiny, and the IRS believes it may recover significant uncollected taxes from audits of these complex returns.

- Estimates of underreported tax liabilities from nonlabor income (e.g., from certain partnerships and sole proprietorships) makes pass-through returns a probable target of future examinations.

- Addressing offshore tax evasion may become a higher priority because the resource limitations that had restricted the IRS’s enforcement of the Foreign Account Tax Compliance Act will be reversed.

- Increased auditing by an enlarged IRS may unwittingly ensnare compliant returns unless the IRS devises a reliable way to sort audit-worthy returns from other returns.

- Bolstering information return reporting requirements for income, expenses and other tax items has been discussed as a way to increase visibility for the tax system.

- Compliance costs, including expenses related to IRS audits, are expected to increase for individuals at the high-end of the income spectrum, pass-through entities and corporations.

- Clarity may come before March 2023 on how the IRS intends to spend its enforcement funds on audit and nonaudit tools for collecting unpaid taxes from targeted income sources.

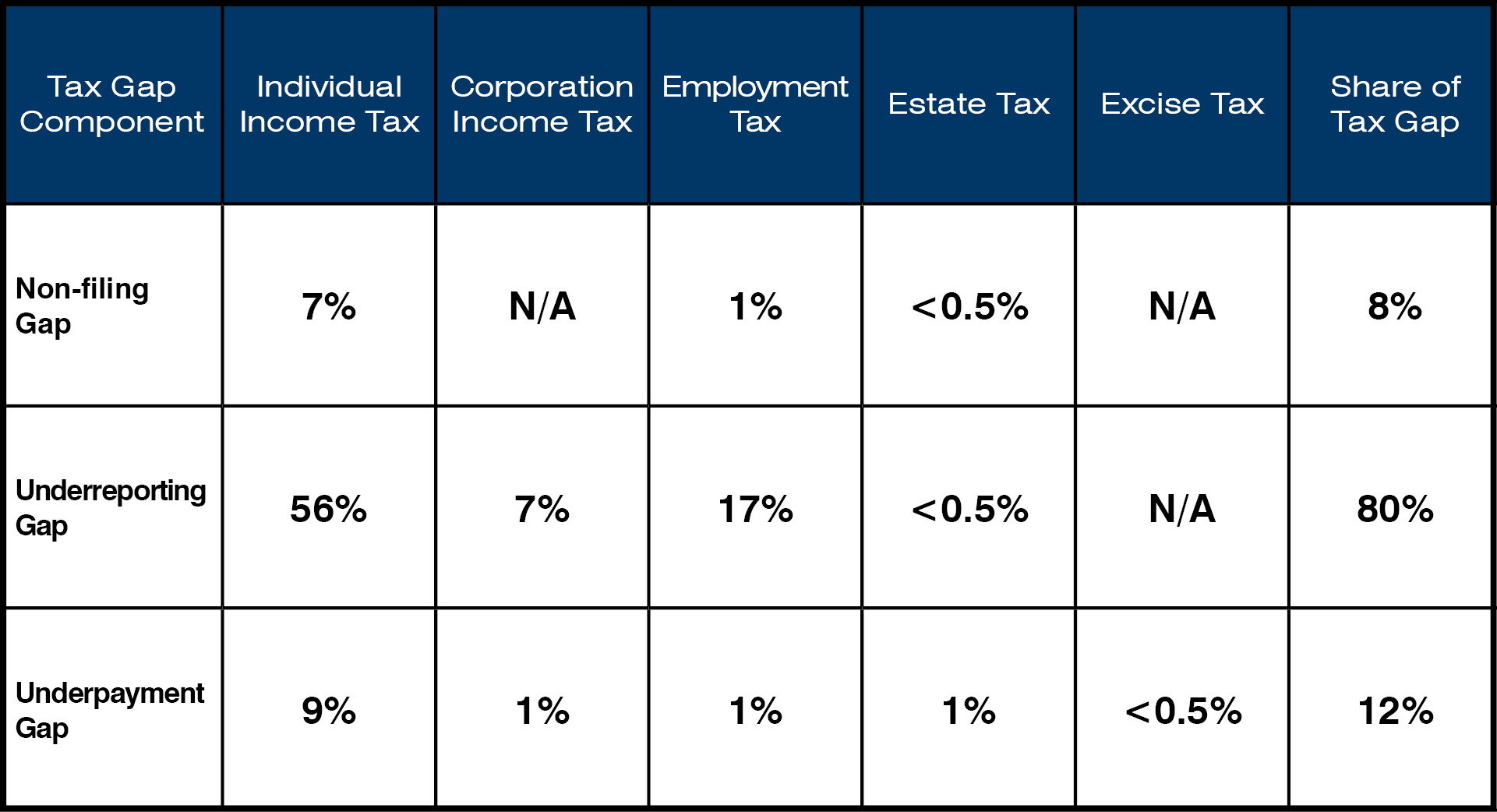

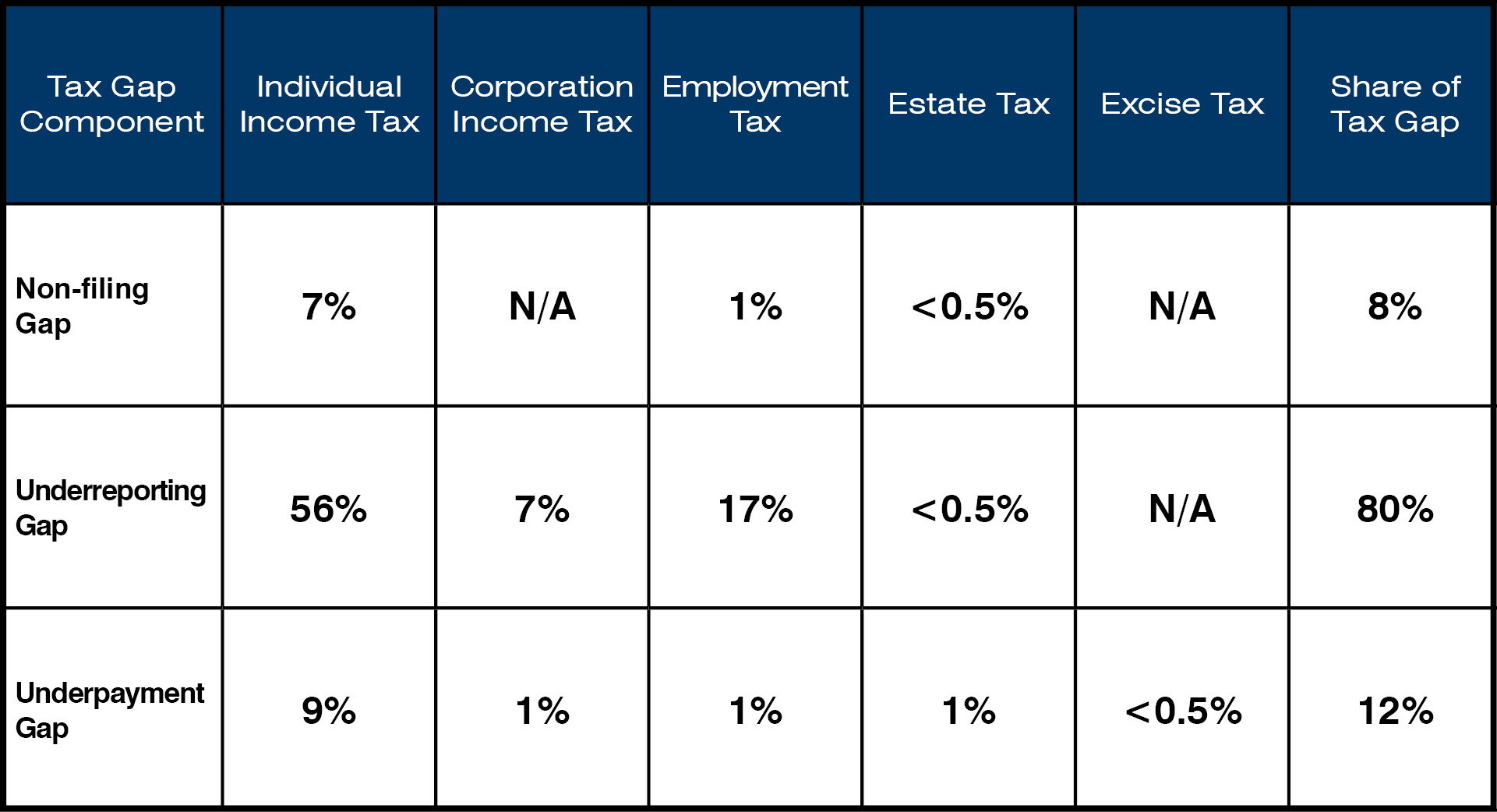

The Congressional Budget Office (“CBO”) estimates that the IRS has the potential to recoup $180.4 billion in taxes over the 2022–2031 period.3 This amount is a function of three components of the tax gap: (i) not filing tax returns (the “nonfiling” tax gap), (ii) underreporting tax on timely returns by underreporting income or taking excess deductions/credits (the “underreporting” tax gap) and (iii) underpaying taxes reported on timely returns (the “underpayment” tax gap).4 The IRS may recover uncollected taxes in these categories through several audit and nonaudit tools:

- searching for nonfilers and securing their returns;

- auditing filed tax returns of individuals and entities;

- collecting taxes due through liens, levies, or by working with taxpayers;

- verifying taxpayer data reported to the tax system;

- fixing errors from clerical mistakes or bad math;

- identifying refunds warranting more scrutiny; and

- performing criminal investigations.

The degradation of the IRS’s enforcement function in recent years resulted in a steep decline in audit rates across all filing categories since 2010.5 For example, the audit rate for individuals with incomes of $1 million or more decreased by 75 percent.6 The most pronounced decline came from complex audits performed by experienced agents. Complex audits typically require manual review of multiple issues and detailed evaluation of some of the more complicated tax issues. There are strong signals that such high-end returns will be the focus of future enforcement efforts because of their revenue-generating potential. The Government Accountability Office has stated, for example, that audits of high-end taxpayers “can generate high amounts of recommended taxes so the recommended additional tax per audit hour is higher than other income groups.”7 Moreover, there is a perception among government officials that funding limitations have forced the IRS to take a narrow enforcement approach to FATCA compliance.8 For affected taxpayers, this means that preparation of an audit-ready file supporting tax return positions will be important during the life cycle of complex transactions/structures and other activities so as to support their defense upon audit.

II. ENFORCEMENT PRIORITIES UNDER THE IRA

A. Listed IRA Priorities

The IRA includes an increase in IRS funding of $45,637,400,000 that is directed for specific tax enforcement activities. Although the IRA describes the funded activities in general terms, five specific activities are enumerated:

- determining and collecting owed taxes;

- providing legal and litigation support;

- conducting criminal investigations (including investigative technology);

- providing digital asset monitoring and compliance activities; and

- enforcing criminal statutes related to violations of internal revenue laws and other financial crimes.

These statutory categories are broad enough to capture different taxes and taxpayers. The IRA does not provide guidance concerning the IRS’s priorities or how the IRS should spend these additional enforcement resources. This absence may reflect a practical decision by Congress to allow the Treasury and the IRS to determine productive uses of enforcement appropriations and to take into account the administrative cost of enforcement in making those decisions. Thus, Congress has ceded decisioning making on these efforts to those on the front lines with respect to the following:

- the types of taxes subject to enforcement (individual income tax, corporate income tax, employment tax, estate tax, and excise tax);

- modifying or increasing reporting requirements items of income, gain, loss, deduction, or credit;

- audit targets among the filing categories;

- audit rates across the income spectrum; and

- decisions to change enforcement priorities over time.

B. Limitations Imposed by the Treasury

The IRA does not shield any segment of the income spectrum from enforcement. However, its supporters indicated that the legislation was not intended to raise audit rates for taxpayers with income below $400,000.9 An amendment was considered that prohibited the IRS from using the appropriations to audit taxpayers with taxable incomes below $400,000. While this limitation was not adopted, the Treasury has directed the IRS not to increase audit scrutiny of small businesses or middle-income individuals (i.e., taxpayers with income less than $400,000) relative to historic rates (the “Directive”).10

The Directive indicates that “high-end” likely means earnings in excess of $400,000. The Directive indicates that small business and middle-income returns will not see an increase in audit rates. It states that audit rates will not rise (relative to historic levels) for small businesses and households earning $400,000 per year or less. The Directive provides, instead, that enforcement resources should be targeted at the high-end of the income spectrum, where at least $160 billion of taxes are uncollected annually.

The CBO expects the IRS will comply with the Directive, which may mean the following:

- the audit limitation will shift more scrutiny to compliant high-end returns and away from nonhigh-end returns that are not compliant (which may result in less tax revenue collected as a result of these audits);

- the number of audits of small businesses and middle-income taxpayers may increase since “historic” audit rates were higher than recent audit rates; and

- the limitation does not apply to the use of nonaudit enforcement tools, meaning that funds may be used on other enforcement actions against small business and middle-income taxpayers.

III. ENFORCEMENT PRIORITIES

It is doubtful election-year rhetoric of the legislative process provides practical insight into future IRS enforcement activities. More relevant are reports on the tax gap published prior to the IRA. This guidance indicates the payoff from enlarging the IRS will come from high-end audits.

A. IRS Estimates of Noncompliance

The IRS estimates the voluntary compliance rate (the tax paid voluntarily and timely divided by the total true tax) to be approximately 85 percent in recent years.11 Tax noncompliance results in billions of lost revenue annually. The IRS recently released an updated tax gap estimate for tax years 2014–2016 showing the estimated gross tax gap increased to $496 billion, an increase of approximately $58 billion from the prior estimate for 2011–2013.12 The recent update projects the gross tax gap to be $540 billion for 2017–2019. IRS data attributed the tax gap to three sources: (i) 80 percent from underreporting, (ii) 12 percent from underpayment and (iii) 8 percent from nonfiling. The IRS broke the numbers down into the following filing categories (no data was available for nonfiling corporations).13

Individuals account for a large share of the overall tax gap. Focusing on their high-end returns is consistent with the view of the Treasury and the IRS concerning who would be productive targets for enforcement activities. The IRS estimated that 26 percent and 12 percent of the gross tax gap is attributable to underreported business income and nonbusiness income, respectively, of individuals. Nonfarm proprietor income was estimated to have a 57 percent misreporting rate. Pass-through income was estimated to have a 12 percent misreporting rate. These rates are likely a function of limited tax reporting since most of this reporting is voluntary without third-party verification—pass-through income is subject to some information reporting and nonfarm proprietor income is subject to little or no information reporting. By contrast, wages are subject to automatic withholding and reporting and was estimated to have only a 1 percent misreporting rate. This data suggests the following:

- enforcement scrutiny by an enlarged IRS may focus on income streams that flow outside the tax system due to low-or-no withholding or information reporting; and

- the largest payoff for the IRS will likely come from high-end audits because (i) high-end taxpayers generate larger amounts of nonwage income so the revenue payoff would be larger than lower-end taxpayers who primarily earn wage income and (ii) the nonwage categories of income on high-end returns are less visible to the tax system.

This data may have informed the IRS Strategic Plan for Fiscal Years 2022–2026 (the “Strategic Plan”).14 In this plan, the IRS outlined its goals to improve taxpayer service and tax administration and the plan serves as a roadmap for the IRS’s programs and operations. Narrowing the tax gap is one of four primary goals, and the Strategic Plan indicates that the IRS will focus its enforcement efforts on high-end noncompliance. The plan states the IRS “is increasing focus on noncompliant, high-income and high-wealth taxpayers, business partnerships and large corporations that make up a disproportionate share of unpaid taxes.”

B. Signals from the Treasury

1. Lead-Up to the IRA

The Treasury’s view is that high-end taxpayers are responsible for a disproportionate amount of tax noncompliance because their income arises from opaque income categories with high misreporting rates (e.g., partnership and sole proprietorship income).15 The Treasury stated that (i) half of the individual income tax gap accrues to income from proprietorship, partnerships and S corporations where there is no-or-low information available to verify tax filings and (ii) a significant share of this income accrues to high-end taxpayers.16 Moreover, on May 20, 2021, the Treasury published a report describing tax compliance initiatives to reduce the tax gap that reflects this view (the “Tax Compliance Agenda”). The Tax Compliance Agenda highlighted the following:17

- The size of the tax gap for partnership, S corporation and proprietorship income is estimated at around $200 billion annually with the net misreporting percentage for certain income categories exceeding 50 percent.

- There has been a decline in the IRS workforce of specialized auditors needed to examine complex structures involving (among other things) partnerships and multi-tier pass-through entities, even though the share of partnership income as a share of total income has grown from less than 5 percent in 1990 to more than 35 percent.

- Audits of passthroughs are limited: (i) 140 of 4.2 million partnership returns were audited in 2018 and (ii) 397 of 4.8 million S corporation returns were audited in 2018.

- There are enhanced opportunities for high-end taxpayers to shield income from tax liability (and audits) through sophisticated strategies such as creating complex partnership structures.

- Examining partnership returns is resource-intensive for the IRS because of tiered organizational structures where tiers of U.S. (and sometimes non-U.S.) entities combine to obscure the ultimate beneficiaries of the business operations.

In light of the foregoing, the Tax Compliance Agenda stressed the need for the following:

- provide the IRS with funding to address sophisticated tax evasion through updated information technology, improved data analytics and hiring talent;

- provide the IRS with more complete information by strengthening reporting to detect opaque sources of income; and

- overhaul obsolete IRS technology to reduce tax evasion.

2. The Yellen Directive and Public Statements

On August 10, 2022, Treasury Secretary Janet Yellen (“Yellen”) issued the Directive to the IRS concerning its IRA spending. The Directive provides that IRA-funded “enforcement resources will focus on high-end noncompliance.” The Directive attributed noncompliance to inadequate auditing of complex returns of “large corporations, high-net-worth individuals and complex pass-throughs.”

The Directive reflects several remarks Yellen made on September 15, 2022 in a speech to IRS personnel concerning the IRA.18 Yellen stated that the “IRS has lacked the resources to effectively audit high earners—whose audits are more complex and take more time—these high earners are responsible for a disproportionate share of unpaid taxes.” In the speech, Yellen highlighted Treasury data that apparently “shows that less than half of all taxes from more complex sources of income are paid.” Thus, “funding will go toward auditing more high earners who have not paid their full bill.”

3. The Operational Plan

The IRS will detail how it intends to use its IRA funding for its strategic initiatives in the IRS Operational Plan (the “Operational Plan”) that Yellen directed the IRS to deliver before March 2023.19 The IRA required the IRS to produce a similar plan before the Directive was removed from the legislation during the Byrd process. The Operational Plan is expected to detail the IRS’s plan for spending enforcement funds over the IRA’s 10-year budget window in the following areas:

- identifying specific operational initiatives and associated timelines for pursuing high-end noncompliance;

- establishing metrics for areas of focus and targets over the IRS’s budget window; and

- detailing how resources will be spent over the budget window on technology, service improvement, and personnel.

If the IRA funding remains intact over its 10-year budget window, the IRS would have more audit and nonaudit tools available to address tax noncompliance. The Operational Plan may also provide clues concerning what nonaudit tools the IRS thinks would be most productive in reducing the tax gap and how these tools may be deployed to decrease the likelihood that compliant taxpayers are subject to audit. Regardless of the allocation of resources among the IRS’s tools, compliance costs are likely to increase for taxpayers.

(1) The IRA appropriates approximately $78,911,000,000 to the IRS. This amount is composed of $3,181,500,000 for taxpayer services, $45,637,400,000 for enforcement, $25,326,400,000 for operations support, $4,750,700,000 for business systems modernization and $15,000,000 for a report on an eFile tax return system. The remainder of the IRA appropriations (approximately $710,533,803) goes to the Treasury Inspector General for Tax administration, Office of Tax Policy, U.S. Tax Court, and Treasury Departmental Offices.

(2) See, e.g., Internal Revenue Service, Report, “Federal Tax Compliance Research: Tax Gap Estimates for Tax Years 2014–2016,” Publ’n 1415 (Oct. 28, 2022) (https://www.irs.gov/pub/irs-pdf/p1415.pdfhttps://www.irs.gov/pub/irs-pdf/p1415.pdf) (the “IRS Tax Gap Estimate”); Natasha Sarin, Deputy Assistant Secretary for Economic Policy, “The Case for a Robust Attack on the Tax Gap” (Sept. 7, 2021) (https://home.treasury.gov/news/featured-stories/the-case-for-a-robust-attack-on-the-tax-gap) (“Treasury Policy Article”).

(3) Phillip L. Swagel, Director of the Congressional Budget Office, Letter to the House of Representatives, Re: Additional Information About Increased Enforcement by the Internal Revenue Service (Aug. 25, 2022) (https://www.cbo.gov/system/files/2022-08/58390-IRS.pdf).

(4) IRS Tax Gap Estimate.

(5) U.S. Government Accountability Office, Report, “Trends of IRS Audit Rates and Results for Individual Taxpayers by Income,” GAO-22-104960 (May 2022) (https://www.gao.gov/assets/gao-22-104960.pdf).

(6) Id.

(7) Id.

(8) Treasury Inspector General For Tax Administration, Report, “Major Management and Performance Challenges Facing the IRS,” 2020-30-015 (Oct. 13, 2022) (https://www.treasury.gov/tigta/management/management_fy2023.pdf).

(9) Janet L. Yellen, Secretary of the Treasury, Letter to Nancy Pelosi, Speaker of the U.S. House of Representatives, (Aug. 2, 2022) (https://home.treasury.gov/system/files/136/Inflation-Reduction-Act-Letter-to-Congress-20220802.pdf).

(10) Janet L. Yellen, Secretary of the Treasury, Letter to Charles P. Rettig, Commissioner of the Internal Revenue Service, Re: The Inflation Reduction Act (Aug. 10, 2022) (https://home.treasury.gov/system/files/136/JLY-letter-to-Commissioner-Rettig-Signed.pdf).

(11) IRS Tax Gap Estimate.

(12) Id.

(13) Id.

(14) Internal Revenue Service, Report, “Strategic Plan FY2022–2026” (July 20, 2022) (https://www.irs.gov/about-irs/irs-strategic-plan).

(15) The Treasury Inspector General For Tax Administration (“TIGTA”) has indicated that high-income nonfilers owe a large amount of taxes. In a report issued in 2020, for example, the TIGTA stated that “The IRS did not work 369,180 high-income nonfilers [for tax years 2014 to 2016], with estimated tax due of $20.8 billion. Of the 369,180 high-income nonfilers, 326,579 were not placed in inventory to be selected for work and 42,601 were closed out of the inventory without ever being worked. In addition, the remaining 510,235 high-income nonfilers, totaling estimated tax due of $24.9 billion, are sitting in one of the Collection function’s inventory streams and will likely not be pursued as resources decline.” Treasury Inspector General For Tax Administration, Report, “High-Income Nonfilers Owing Billions of Dollars Are Not Being Worked by the Internal Revenue Service,” 2020-30-015 (May 29, 2020) (https://www.treasury.gov/tigta/auditreports/2020reports/202030015fr.pdf).

(16) Treasury Policy Article.

(17) Department of the Treasury, Report, “The American Families Plan Tax Compliance Agenda” (May 20, 2021) (https://home.treasury.gov/system/files/136/The-American-Families-Plan-Tax-Compliance-Agenda.pdf).

(18) Remarks by Secretary of the Treasury Janet L. Yellen at the IRS facility in New Carrollton, Md. (Sept. 15, 2022), available at https://home.treasury.gov/news/press-releases/jy0952#_ftn9.

(19) Janet L. Yellen, Secretary of the Treasury, Memorandum for Charles P. Rettig, Commissioner of the Internal Revenue Service, Re: IRS Operational Plan (Aug. 17, 2022).

Vedder Thinking | Articles When the IRS Receives an Additional $80 Billion, Who Will Pay the Price?

Article

November 4, 2022

I. BACKGROUND

The Inflation Reduction Act of 2022 (the “IRA”) provided an $80 billion budget increase for the Internal Revenue Service (the “IRS”) and for non-IRS tax functions.1 How will the IRS spend these additional funds, and who is expected to win and who is likely to suffer from this congressional largess? Although the answers are not certain, a look at how this amount is allocated in the IRA and the announcements of the Department of the Treasury (the “Treasury”) and the IRS give us a pretty good idea.

Approximately $79 billion of this windfall is allocated to the IRS for enforcement, taxpayer services, operations support and business system modernization with $45.6 billion appropriated for tax enforcement activities. The IRS is expected to use these additional enforcement resources to reduce the “tax gap” (the difference between the true tax liability for a taxable year and the amount that is actually paid to the government on a timely basis) through targeted enforcement actions. Some observations regarding these efforts are as follows:

- The estimated annual tax gap that is attributed to the major filing categories—individuals, corporate, employment and estates—is estimated to be $500 to 600 billion depending on the source.2 Thus, audit rates for these taxpayers are expected to increase.

- Enforcement activities are likely to be concentrated at the top of the income spectrum ($400,000 or more, the “high-end”).

- The additional funding is expected to help the IRS overcome the complexity that was shielding high-end returns in certain of these categories from audit scrutiny, and the IRS believes it may recover significant uncollected taxes from audits of these complex returns.

- Estimates of underreported tax liabilities from nonlabor income (e.g., from certain partnerships and sole proprietorships) makes pass-through returns a probable target of future examinations.

- Addressing offshore tax evasion may become a higher priority because the resource limitations that had restricted the IRS’s enforcement of the Foreign Account Tax Compliance Act will be reversed.

- Increased auditing by an enlarged IRS may unwittingly ensnare compliant returns unless the IRS devises a reliable way to sort audit-worthy returns from other returns.

- Bolstering information return reporting requirements for income, expenses and other tax items has been discussed as a way to increase visibility for the tax system.

- Compliance costs, including expenses related to IRS audits, are expected to increase for individuals at the high-end of the income spectrum, pass-through entities and corporations.

- Clarity may come before March 2023 on how the IRS intends to spend its enforcement funds on audit and nonaudit tools for collecting unpaid taxes from targeted income sources.

The Congressional Budget Office (“CBO”) estimates that the IRS has the potential to recoup $180.4 billion in taxes over the 2022–2031 period.3 This amount is a function of three components of the tax gap: (i) not filing tax returns (the “nonfiling” tax gap), (ii) underreporting tax on timely returns by underreporting income or taking excess deductions/credits (the “underreporting” tax gap) and (iii) underpaying taxes reported on timely returns (the “underpayment” tax gap).4 The IRS may recover uncollected taxes in these categories through several audit and nonaudit tools:

- searching for nonfilers and securing their returns;

- auditing filed tax returns of individuals and entities;

- collecting taxes due through liens, levies, or by working with taxpayers;

- verifying taxpayer data reported to the tax system;

- fixing errors from clerical mistakes or bad math;

- identifying refunds warranting more scrutiny; and

- performing criminal investigations.

The degradation of the IRS’s enforcement function in recent years resulted in a steep decline in audit rates across all filing categories since 2010.5 For example, the audit rate for individuals with incomes of $1 million or more decreased by 75 percent.6 The most pronounced decline came from complex audits performed by experienced agents. Complex audits typically require manual review of multiple issues and detailed evaluation of some of the more complicated tax issues. There are strong signals that such high-end returns will be the focus of future enforcement efforts because of their revenue-generating potential. The Government Accountability Office has stated, for example, that audits of high-end taxpayers “can generate high amounts of recommended taxes so the recommended additional tax per audit hour is higher than other income groups.”7 Moreover, there is a perception among government officials that funding limitations have forced the IRS to take a narrow enforcement approach to FATCA compliance.8 For affected taxpayers, this means that preparation of an audit-ready file supporting tax return positions will be important during the life cycle of complex transactions/structures and other activities so as to support their defense upon audit.

II. ENFORCEMENT PRIORITIES UNDER THE IRA

A. Listed IRA Priorities

The IRA includes an increase in IRS funding of $45,637,400,000 that is directed for specific tax enforcement activities. Although the IRA describes the funded activities in general terms, five specific activities are enumerated:

- determining and collecting owed taxes;

- providing legal and litigation support;

- conducting criminal investigations (including investigative technology);

- providing digital asset monitoring and compliance activities; and

- enforcing criminal statutes related to violations of internal revenue laws and other financial crimes.

These statutory categories are broad enough to capture different taxes and taxpayers. The IRA does not provide guidance concerning the IRS’s priorities or how the IRS should spend these additional enforcement resources. This absence may reflect a practical decision by Congress to allow the Treasury and the IRS to determine productive uses of enforcement appropriations and to take into account the administrative cost of enforcement in making those decisions. Thus, Congress has ceded decisioning making on these efforts to those on the front lines with respect to the following:

- the types of taxes subject to enforcement (individual income tax, corporate income tax, employment tax, estate tax, and excise tax);

- modifying or increasing reporting requirements items of income, gain, loss, deduction, or credit;

- audit targets among the filing categories;

- audit rates across the income spectrum; and

- decisions to change enforcement priorities over time.

B. Limitations Imposed by the Treasury

The IRA does not shield any segment of the income spectrum from enforcement. However, its supporters indicated that the legislation was not intended to raise audit rates for taxpayers with income below $400,000.9 An amendment was considered that prohibited the IRS from using the appropriations to audit taxpayers with taxable incomes below $400,000. While this limitation was not adopted, the Treasury has directed the IRS not to increase audit scrutiny of small businesses or middle-income individuals (i.e., taxpayers with income less than $400,000) relative to historic rates (the “Directive”).10

The Directive indicates that “high-end” likely means earnings in excess of $400,000. The Directive indicates that small business and middle-income returns will not see an increase in audit rates. It states that audit rates will not rise (relative to historic levels) for small businesses and households earning $400,000 per year or less. The Directive provides, instead, that enforcement resources should be targeted at the high-end of the income spectrum, where at least $160 billion of taxes are uncollected annually.

The CBO expects the IRS will comply with the Directive, which may mean the following:

- the audit limitation will shift more scrutiny to compliant high-end returns and away from nonhigh-end returns that are not compliant (which may result in less tax revenue collected as a result of these audits);

- the number of audits of small businesses and middle-income taxpayers may increase since “historic” audit rates were higher than recent audit rates; and

- the limitation does not apply to the use of nonaudit enforcement tools, meaning that funds may be used on other enforcement actions against small business and middle-income taxpayers.

III. ENFORCEMENT PRIORITIES

It is doubtful election-year rhetoric of the legislative process provides practical insight into future IRS enforcement activities. More relevant are reports on the tax gap published prior to the IRA. This guidance indicates the payoff from enlarging the IRS will come from high-end audits.

A. IRS Estimates of Noncompliance

The IRS estimates the voluntary compliance rate (the tax paid voluntarily and timely divided by the total true tax) to be approximately 85 percent in recent years.11 Tax noncompliance results in billions of lost revenue annually. The IRS recently released an updated tax gap estimate for tax years 2014–2016 showing the estimated gross tax gap increased to $496 billion, an increase of approximately $58 billion from the prior estimate for 2011–2013.12 The recent update projects the gross tax gap to be $540 billion for 2017–2019. IRS data attributed the tax gap to three sources: (i) 80 percent from underreporting, (ii) 12 percent from underpayment and (iii) 8 percent from nonfiling. The IRS broke the numbers down into the following filing categories (no data was available for nonfiling corporations).13

Individuals account for a large share of the overall tax gap. Focusing on their high-end returns is consistent with the view of the Treasury and the IRS concerning who would be productive targets for enforcement activities. The IRS estimated that 26 percent and 12 percent of the gross tax gap is attributable to underreported business income and nonbusiness income, respectively, of individuals. Nonfarm proprietor income was estimated to have a 57 percent misreporting rate. Pass-through income was estimated to have a 12 percent misreporting rate. These rates are likely a function of limited tax reporting since most of this reporting is voluntary without third-party verification—pass-through income is subject to some information reporting and nonfarm proprietor income is subject to little or no information reporting. By contrast, wages are subject to automatic withholding and reporting and was estimated to have only a 1 percent misreporting rate. This data suggests the following:

- enforcement scrutiny by an enlarged IRS may focus on income streams that flow outside the tax system due to low-or-no withholding or information reporting; and

- the largest payoff for the IRS will likely come from high-end audits because (i) high-end taxpayers generate larger amounts of nonwage income so the revenue payoff would be larger than lower-end taxpayers who primarily earn wage income and (ii) the nonwage categories of income on high-end returns are less visible to the tax system.

This data may have informed the IRS Strategic Plan for Fiscal Years 2022–2026 (the “Strategic Plan”).14 In this plan, the IRS outlined its goals to improve taxpayer service and tax administration and the plan serves as a roadmap for the IRS’s programs and operations. Narrowing the tax gap is one of four primary goals, and the Strategic Plan indicates that the IRS will focus its enforcement efforts on high-end noncompliance. The plan states the IRS “is increasing focus on noncompliant, high-income and high-wealth taxpayers, business partnerships and large corporations that make up a disproportionate share of unpaid taxes.”

B. Signals from the Treasury

1. Lead-Up to the IRA

The Treasury’s view is that high-end taxpayers are responsible for a disproportionate amount of tax noncompliance because their income arises from opaque income categories with high misreporting rates (e.g., partnership and sole proprietorship income).15 The Treasury stated that (i) half of the individual income tax gap accrues to income from proprietorship, partnerships and S corporations where there is no-or-low information available to verify tax filings and (ii) a significant share of this income accrues to high-end taxpayers.16 Moreover, on May 20, 2021, the Treasury published a report describing tax compliance initiatives to reduce the tax gap that reflects this view (the “Tax Compliance Agenda”). The Tax Compliance Agenda highlighted the following:17

- The size of the tax gap for partnership, S corporation and proprietorship income is estimated at around $200 billion annually with the net misreporting percentage for certain income categories exceeding 50 percent.

- There has been a decline in the IRS workforce of specialized auditors needed to examine complex structures involving (among other things) partnerships and multi-tier pass-through entities, even though the share of partnership income as a share of total income has grown from less than 5 percent in 1990 to more than 35 percent.

- Audits of passthroughs are limited: (i) 140 of 4.2 million partnership returns were audited in 2018 and (ii) 397 of 4.8 million S corporation returns were audited in 2018.

- There are enhanced opportunities for high-end taxpayers to shield income from tax liability (and audits) through sophisticated strategies such as creating complex partnership structures.

- Examining partnership returns is resource-intensive for the IRS because of tiered organizational structures where tiers of U.S. (and sometimes non-U.S.) entities combine to obscure the ultimate beneficiaries of the business operations.

In light of the foregoing, the Tax Compliance Agenda stressed the need for the following:

- provide the IRS with funding to address sophisticated tax evasion through updated information technology, improved data analytics and hiring talent;

- provide the IRS with more complete information by strengthening reporting to detect opaque sources of income; and

- overhaul obsolete IRS technology to reduce tax evasion.

2. The Yellen Directive and Public Statements

On August 10, 2022, Treasury Secretary Janet Yellen (“Yellen”) issued the Directive to the IRS concerning its IRA spending. The Directive provides that IRA-funded “enforcement resources will focus on high-end noncompliance.” The Directive attributed noncompliance to inadequate auditing of complex returns of “large corporations, high-net-worth individuals and complex pass-throughs.”

The Directive reflects several remarks Yellen made on September 15, 2022 in a speech to IRS personnel concerning the IRA.18 Yellen stated that the “IRS has lacked the resources to effectively audit high earners—whose audits are more complex and take more time—these high earners are responsible for a disproportionate share of unpaid taxes.” In the speech, Yellen highlighted Treasury data that apparently “shows that less than half of all taxes from more complex sources of income are paid.” Thus, “funding will go toward auditing more high earners who have not paid their full bill.”

3. The Operational Plan

The IRS will detail how it intends to use its IRA funding for its strategic initiatives in the IRS Operational Plan (the “Operational Plan”) that Yellen directed the IRS to deliver before March 2023.19 The IRA required the IRS to produce a similar plan before the Directive was removed from the legislation during the Byrd process. The Operational Plan is expected to detail the IRS’s plan for spending enforcement funds over the IRA’s 10-year budget window in the following areas:

- identifying specific operational initiatives and associated timelines for pursuing high-end noncompliance;

- establishing metrics for areas of focus and targets over the IRS’s budget window; and

- detailing how resources will be spent over the budget window on technology, service improvement, and personnel.

If the IRA funding remains intact over its 10-year budget window, the IRS would have more audit and nonaudit tools available to address tax noncompliance. The Operational Plan may also provide clues concerning what nonaudit tools the IRS thinks would be most productive in reducing the tax gap and how these tools may be deployed to decrease the likelihood that compliant taxpayers are subject to audit. Regardless of the allocation of resources among the IRS’s tools, compliance costs are likely to increase for taxpayers.

(1) The IRA appropriates approximately $78,911,000,000 to the IRS. This amount is composed of $3,181,500,000 for taxpayer services, $45,637,400,000 for enforcement, $25,326,400,000 for operations support, $4,750,700,000 for business systems modernization and $15,000,000 for a report on an eFile tax return system. The remainder of the IRA appropriations (approximately $710,533,803) goes to the Treasury Inspector General for Tax administration, Office of Tax Policy, U.S. Tax Court, and Treasury Departmental Offices.

(2) See, e.g., Internal Revenue Service, Report, “Federal Tax Compliance Research: Tax Gap Estimates for Tax Years 2014–2016,” Publ’n 1415 (Oct. 28, 2022) (https://www.irs.gov/pub/irs-pdf/p1415.pdfhttps://www.irs.gov/pub/irs-pdf/p1415.pdf) (the “IRS Tax Gap Estimate”); Natasha Sarin, Deputy Assistant Secretary for Economic Policy, “The Case for a Robust Attack on the Tax Gap” (Sept. 7, 2021) (https://home.treasury.gov/news/featured-stories/the-case-for-a-robust-attack-on-the-tax-gap) (“Treasury Policy Article”).

(3) Phillip L. Swagel, Director of the Congressional Budget Office, Letter to the House of Representatives, Re: Additional Information About Increased Enforcement by the Internal Revenue Service (Aug. 25, 2022) (https://www.cbo.gov/system/files/2022-08/58390-IRS.pdf).

(4) IRS Tax Gap Estimate.

(5) U.S. Government Accountability Office, Report, “Trends of IRS Audit Rates and Results for Individual Taxpayers by Income,” GAO-22-104960 (May 2022) (https://www.gao.gov/assets/gao-22-104960.pdf).

(6) Id.

(7) Id.

(8) Treasury Inspector General For Tax Administration, Report, “Major Management and Performance Challenges Facing the IRS,” 2020-30-015 (Oct. 13, 2022) (https://www.treasury.gov/tigta/management/management_fy2023.pdf).

(9) Janet L. Yellen, Secretary of the Treasury, Letter to Nancy Pelosi, Speaker of the U.S. House of Representatives, (Aug. 2, 2022) (https://home.treasury.gov/system/files/136/Inflation-Reduction-Act-Letter-to-Congress-20220802.pdf).

(10) Janet L. Yellen, Secretary of the Treasury, Letter to Charles P. Rettig, Commissioner of the Internal Revenue Service, Re: The Inflation Reduction Act (Aug. 10, 2022) (https://home.treasury.gov/system/files/136/JLY-letter-to-Commissioner-Rettig-Signed.pdf).

(11) IRS Tax Gap Estimate.

(12) Id.

(13) Id.

(14) Internal Revenue Service, Report, “Strategic Plan FY2022–2026” (July 20, 2022) (https://www.irs.gov/about-irs/irs-strategic-plan).

(15) The Treasury Inspector General For Tax Administration (“TIGTA”) has indicated that high-income nonfilers owe a large amount of taxes. In a report issued in 2020, for example, the TIGTA stated that “The IRS did not work 369,180 high-income nonfilers [for tax years 2014 to 2016], with estimated tax due of $20.8 billion. Of the 369,180 high-income nonfilers, 326,579 were not placed in inventory to be selected for work and 42,601 were closed out of the inventory without ever being worked. In addition, the remaining 510,235 high-income nonfilers, totaling estimated tax due of $24.9 billion, are sitting in one of the Collection function’s inventory streams and will likely not be pursued as resources decline.” Treasury Inspector General For Tax Administration, Report, “High-Income Nonfilers Owing Billions of Dollars Are Not Being Worked by the Internal Revenue Service,” 2020-30-015 (May 29, 2020) (https://www.treasury.gov/tigta/auditreports/2020reports/202030015fr.pdf).

(16) Treasury Policy Article.

(17) Department of the Treasury, Report, “The American Families Plan Tax Compliance Agenda” (May 20, 2021) (https://home.treasury.gov/system/files/136/The-American-Families-Plan-Tax-Compliance-Agenda.pdf).

(18) Remarks by Secretary of the Treasury Janet L. Yellen at the IRS facility in New Carrollton, Md. (Sept. 15, 2022), available at https://home.treasury.gov/news/press-releases/jy0952#_ftn9.

(19) Janet L. Yellen, Secretary of the Treasury, Memorandum for Charles P. Rettig, Commissioner of the Internal Revenue Service, Re: IRS Operational Plan (Aug. 17, 2022).

-

Services