Tax Reform’s Impact on Transportation Finance Transactions

Overview

New tax legislation was signed into law on December 22, 2017 (the Act).1 The Act lowers the corporate rate from a top graduated rate of 35 percent to a flat rate of 21 percent. Under the Act individuals and certain non-corporate taxpayers (including trusts and estates) are allowed to deduct 20 percent of “qualified business income” earned through partnerships, S corporations or sole proprietorships, subject to various limitations.

In addition, the Act generally eliminates the two-year net operating loss (NOL) carryback provision for NOLs incurred in taxable years ending after December 31, 2017 but permits indefinite carryforward of such NOLs, subject to a limitation that only 80 percent of taxable income can be offset by NOLs arising in taxable years beginning after December 31, 2017.

Finally, the Act makes a number of additional changes relevant to transportation finance transactions that are highlighted below.

New 100 Percent Bonus Depreciation

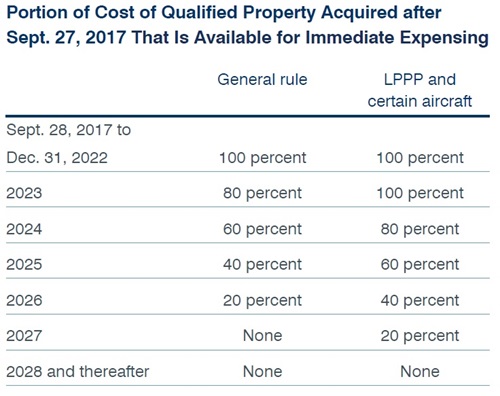

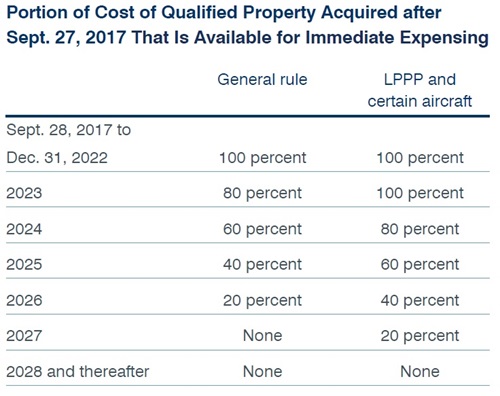

In general, the Act expands bonus depreciation rules to permit 100 percent immediate expensing (rather than depreciation over time) of the cost of the certain tangible property, including aircraft, railcars and ships, in each case acquired and placed into service after September 27, 2017 but before January 1, 2023. These bonus expensing provisions begin to phase down by 20 percent each year in which such tangible property is placed into service beginning in 2023.

In addition to immediate expensing of the cost of new property, the Act provides that used equipment is eligible for such bonus depreciation, which is a significant expansion of the bonus depreciation rules. For used tangible property to qualify for bonus depreciation, the taxpayer must have paid or incurred the cost to purchase such tangible property (so that this property is acquired in a taxable, arm’s-length transaction), and the taxpayer may not have used this property prior to its acquisition. However, there is no limitation on such expensing with respect to a sale-leaseback of tangible property, even though the user of such tangible property remains the same. Thus, an aircraft that was purchased by a taxpayer could continue to be used by such taxpayer while such taxpayer engages in a sale-leaseback transaction with a third party (perhaps with a goal of repaying the debt that such taxpayer incurred in acquiring such aircraft originally, although such a sale would trigger taxpayer’s gain in such aircraft), and such third party would be permitted to immediately expense the purchase price.

The 100 percent immediate expensing under the Act is also available for certain tangible property (other than the aircraft discussed in this paragraph) that is referred to as a longer production period property (LPPP) which (i) is acquired before January 1, 2027 and placed into service before January 1, 2024 (rather than 2023), (ii) has at least a 10-year depreciation recovery period (but not more than a 20-year depreciation recovery period) or is “transportation property” (i.e., property that is used in the trade or business of transporting persons or property) and (iii) satisfies certain additional requirements. In addition, the 100 percent immediate expensing under the Act applies to an aircraft (that is not “transportation property” other than for agricultural or firefighting purposes) which is acquired before January 1, 2027 and that is placed into service before January 1, 2024 if such aircraft has an estimated production period exceeding four months and satisfies certain additional requirements. In the case of both LPPP and such aircraft, the phase down of immediate expensing is by 20 percent each year beginning in 2024 (rather than 2023).

Here is a summary of the bonus depreciation schedule with respect to applicable tangible property:

It should be noted that 100 percent immediate expensing should be elected with caution. In light of the limitation mentioned above that only 80 percent of taxable income can be offset by NOLs arising in taxable years beginning after December 31, 2017, if this 80 percent limitation is likely to be reached, it may make sense in certain cases not to make this election. After all, if this election is not made, although the depreciation deduction will be taken on a less accelerated basis, this 80 percent limitation may be less likely to apply, and, depending on the facts of any given case, the taxpayer may thus come out ahead.2

It should also be noted that some taxpayers may think they qualify for this deduction even in the case of mainly personal use of their means of transportation (such as an aircraft). However, this expansion has application only to property that is predominantly used in a qualified business use in a given taxable year.3

Limitations on Interest Deductions

Under the Act, a business may not deduct net interest expense that exceeds 30 percent of business’s adjusted taxable income (which is defined generally as EBITDA through 2021, and EBIT thereafter), although the disallowed interest may be carried forward indefinitely. Thus, businesses that seek financing that could be subject to this new limitation on interest deductions may be incentivized not to seek debt financing. Instead, these businesses may consider structuring their financing using a sale-leaseback (or leveraged lease) technique. If such structuring is not available and debt financing is unavoidable, perhaps these businesses could employ rent structuring using Section 467 so as to create deemed interest income that would offset the interest expense from such debt financing (since the 30 percent limitation applies to the net interest expense–i.e., interest expense net of interest income).

Hobby Loss Limitations

Prior to the Act, the hobby loss rules under Section 183 permitted deductions for associated expenses to offset the income from activities not engaged in for profit (i.e., hobbies) of individuals, S corporations, trust and estates, and partnerships.4 These deductions were treated as miscellaneous itemized deductions and thus, although available, were subject to certain limitations under the Code. The Act has eliminated this deduction entirely for any taxable year beginning after December 31, 2017 and before January 1, 2026. As a result, if an activity is found to be a hobby, rather than engaged in for profit, the income generated by such activity would be subject to tax but no associated deduction would be available within such eight-year timeframe (assuming this change in law is not made permanent). So, it has become even more significant for an activity involving aircraft (or any other transportation vehicle) to be determined to be engaged in a for profit activity, rather than a hobby.

FET Changes

As a general matter, domestic air transportation of persons and property is subject to certain federal excise taxes (FET) under Sections 4261 and 4271, respectively, on the amounts paid therefor. In 2012 the Internal Revenue Service (IRS) issued Chief Counsel Advice5 advising taxpayers that the management company’s services to the owner of the aircraft were subject to FET if the management company made basically all decisions with respect to operation and maintenance of the owner’s aircraft, even though the aircraft was not used for charters with third parties. This created significant uncertainty in the transportation industry, although the IRS has since scaled back its audit efforts on this issue. The Act provides much needed clarification. Under the Act, the payments by an aircraft owner (or a lessee that leases the aircraft other than under a disqualified lease)6 to a management company for services related to maintenance and support of such aircraft or flights on such aircraft are exempt from FET. Also, the Act lists various specific instances of such services, such as provision of pilots and crew, and has a general catch-all for all other services that are necessary to support flights operated by an aircraft owner (or a lessee that leases the aircraft other than under a disqualified lease).

It should be noted that in the legislative history under the Act it is indicated that ownership of stock in a commercial airline and participation in a fractional ownership aircraft program are not intended to qualify one as an aircraft owner, so amounts paid for transportation on such flights continue to be subject to FET.7

Elimination of Corporate AMT

The Act eliminates corporate alternative minimum tax (AMT). Before the implementation of the Act, taxpayers subject to corporate AMT avoided acquiring title to capital assets like equipment, since a portion of the associated depreciation was not permitted under corporate AMT. Instead, such taxpayers benefitted, from a tax perspective, by leasing such equipment. Now that corporate AMT has been eliminated, all available equipment financing options should be explored or reassessed.

Elimination of 1031 Exchanges

The Act limits tax-free exchanges pursuant to Section 1031 to real property only (with certain transition rules with respect to exchanges that were initiated on or prior to December 31, 2017). Thus, as a general matter an aircraft can no longer be exchanged for another aircraft without recognition of gain to both aircraft owners in the exchange.

The elimination of Section 1031 exchanges for non-real property is ameliorated by the new provision discussed above permitting immediate expensing of as much as 100 percent of the cost of certain tangible property. Still, the phase down of these bonus depreciation provisions will generally mean that over time transactions may require significant planning to minimize tax impact.

Conclusion

This article is only a brief summary of certain provisions implemented or revised by the Act. Future guidance will hopefully clarify various aspects of the Act and its impact on state or local taxation. One thing is clear, however; the Act represents a major overhaul of the U.S. federal tax system.

Click below to download the complete newsletter featuring this article.

1 All section references are to sections of the Internal Revenue Code of 1986, as amended (Code).

2 The 100 percent immediate expensing election applies to all assets in a given depreciation class, not on an asset-by-asset basis. That is, cherry-picking of assets in a given depreciation class is not permitted.

3 Qualified business use for this purpose is, with certain exceptions, use by the taxpayer in a trade or business of such taxpayer. Section 280F(d)(6). Also, property is predominantly used for this purpose if the percentage of the use of such property during a given taxable year in a qualified business use exceeds 50 percent. Section 280F(b)(3).

4 The determination of whether an activity is a hobby generally requires a facts and circumstances analysis, applying various factors. However, there is a presumption that if “gross income derived from an activity for 3 or more of the taxable years in the period of 5 consecutive taxable years which ends with the taxable year exceeds the deductions attributable to such activity,” then such activity is not a hobby. Sec. 183(c).

5 Office of Chief Counsel, I.R.S., Chief Counsel Advice No. 201210026 (Mar. 9, 2012).

6 A “disqualified lease” for this purpose is a lease from a provider of management services (or a related person) if such lease is for a term of 31 days or less.

7 Flights under the fractional ownership aircraft program are not subject to FET if such flights are subject to an additional fuel surtax of 14.1 cents per gallon under Section 4043.

Vedder Thinking | Articles Tax Reform’s Impact on Transportation Finance Transactions

Newsletter

August 2018

Overview

New tax legislation was signed into law on December 22, 2017 (the Act).1 The Act lowers the corporate rate from a top graduated rate of 35 percent to a flat rate of 21 percent. Under the Act individuals and certain non-corporate taxpayers (including trusts and estates) are allowed to deduct 20 percent of “qualified business income” earned through partnerships, S corporations or sole proprietorships, subject to various limitations.

In addition, the Act generally eliminates the two-year net operating loss (NOL) carryback provision for NOLs incurred in taxable years ending after December 31, 2017 but permits indefinite carryforward of such NOLs, subject to a limitation that only 80 percent of taxable income can be offset by NOLs arising in taxable years beginning after December 31, 2017.

Finally, the Act makes a number of additional changes relevant to transportation finance transactions that are highlighted below.

New 100 Percent Bonus Depreciation

In general, the Act expands bonus depreciation rules to permit 100 percent immediate expensing (rather than depreciation over time) of the cost of the certain tangible property, including aircraft, railcars and ships, in each case acquired and placed into service after September 27, 2017 but before January 1, 2023. These bonus expensing provisions begin to phase down by 20 percent each year in which such tangible property is placed into service beginning in 2023.

In addition to immediate expensing of the cost of new property, the Act provides that used equipment is eligible for such bonus depreciation, which is a significant expansion of the bonus depreciation rules. For used tangible property to qualify for bonus depreciation, the taxpayer must have paid or incurred the cost to purchase such tangible property (so that this property is acquired in a taxable, arm’s-length transaction), and the taxpayer may not have used this property prior to its acquisition. However, there is no limitation on such expensing with respect to a sale-leaseback of tangible property, even though the user of such tangible property remains the same. Thus, an aircraft that was purchased by a taxpayer could continue to be used by such taxpayer while such taxpayer engages in a sale-leaseback transaction with a third party (perhaps with a goal of repaying the debt that such taxpayer incurred in acquiring such aircraft originally, although such a sale would trigger taxpayer’s gain in such aircraft), and such third party would be permitted to immediately expense the purchase price.

The 100 percent immediate expensing under the Act is also available for certain tangible property (other than the aircraft discussed in this paragraph) that is referred to as a longer production period property (LPPP) which (i) is acquired before January 1, 2027 and placed into service before January 1, 2024 (rather than 2023), (ii) has at least a 10-year depreciation recovery period (but not more than a 20-year depreciation recovery period) or is “transportation property” (i.e., property that is used in the trade or business of transporting persons or property) and (iii) satisfies certain additional requirements. In addition, the 100 percent immediate expensing under the Act applies to an aircraft (that is not “transportation property” other than for agricultural or firefighting purposes) which is acquired before January 1, 2027 and that is placed into service before January 1, 2024 if such aircraft has an estimated production period exceeding four months and satisfies certain additional requirements. In the case of both LPPP and such aircraft, the phase down of immediate expensing is by 20 percent each year beginning in 2024 (rather than 2023).

Here is a summary of the bonus depreciation schedule with respect to applicable tangible property:

It should be noted that 100 percent immediate expensing should be elected with caution. In light of the limitation mentioned above that only 80 percent of taxable income can be offset by NOLs arising in taxable years beginning after December 31, 2017, if this 80 percent limitation is likely to be reached, it may make sense in certain cases not to make this election. After all, if this election is not made, although the depreciation deduction will be taken on a less accelerated basis, this 80 percent limitation may be less likely to apply, and, depending on the facts of any given case, the taxpayer may thus come out ahead.2

It should also be noted that some taxpayers may think they qualify for this deduction even in the case of mainly personal use of their means of transportation (such as an aircraft). However, this expansion has application only to property that is predominantly used in a qualified business use in a given taxable year.3

Limitations on Interest Deductions

Under the Act, a business may not deduct net interest expense that exceeds 30 percent of business’s adjusted taxable income (which is defined generally as EBITDA through 2021, and EBIT thereafter), although the disallowed interest may be carried forward indefinitely. Thus, businesses that seek financing that could be subject to this new limitation on interest deductions may be incentivized not to seek debt financing. Instead, these businesses may consider structuring their financing using a sale-leaseback (or leveraged lease) technique. If such structuring is not available and debt financing is unavoidable, perhaps these businesses could employ rent structuring using Section 467 so as to create deemed interest income that would offset the interest expense from such debt financing (since the 30 percent limitation applies to the net interest expense–i.e., interest expense net of interest income).

Hobby Loss Limitations

Prior to the Act, the hobby loss rules under Section 183 permitted deductions for associated expenses to offset the income from activities not engaged in for profit (i.e., hobbies) of individuals, S corporations, trust and estates, and partnerships.4 These deductions were treated as miscellaneous itemized deductions and thus, although available, were subject to certain limitations under the Code. The Act has eliminated this deduction entirely for any taxable year beginning after December 31, 2017 and before January 1, 2026. As a result, if an activity is found to be a hobby, rather than engaged in for profit, the income generated by such activity would be subject to tax but no associated deduction would be available within such eight-year timeframe (assuming this change in law is not made permanent). So, it has become even more significant for an activity involving aircraft (or any other transportation vehicle) to be determined to be engaged in a for profit activity, rather than a hobby.

FET Changes

As a general matter, domestic air transportation of persons and property is subject to certain federal excise taxes (FET) under Sections 4261 and 4271, respectively, on the amounts paid therefor. In 2012 the Internal Revenue Service (IRS) issued Chief Counsel Advice5 advising taxpayers that the management company’s services to the owner of the aircraft were subject to FET if the management company made basically all decisions with respect to operation and maintenance of the owner’s aircraft, even though the aircraft was not used for charters with third parties. This created significant uncertainty in the transportation industry, although the IRS has since scaled back its audit efforts on this issue. The Act provides much needed clarification. Under the Act, the payments by an aircraft owner (or a lessee that leases the aircraft other than under a disqualified lease)6 to a management company for services related to maintenance and support of such aircraft or flights on such aircraft are exempt from FET. Also, the Act lists various specific instances of such services, such as provision of pilots and crew, and has a general catch-all for all other services that are necessary to support flights operated by an aircraft owner (or a lessee that leases the aircraft other than under a disqualified lease).

It should be noted that in the legislative history under the Act it is indicated that ownership of stock in a commercial airline and participation in a fractional ownership aircraft program are not intended to qualify one as an aircraft owner, so amounts paid for transportation on such flights continue to be subject to FET.7

Elimination of Corporate AMT

The Act eliminates corporate alternative minimum tax (AMT). Before the implementation of the Act, taxpayers subject to corporate AMT avoided acquiring title to capital assets like equipment, since a portion of the associated depreciation was not permitted under corporate AMT. Instead, such taxpayers benefitted, from a tax perspective, by leasing such equipment. Now that corporate AMT has been eliminated, all available equipment financing options should be explored or reassessed.

Elimination of 1031 Exchanges

The Act limits tax-free exchanges pursuant to Section 1031 to real property only (with certain transition rules with respect to exchanges that were initiated on or prior to December 31, 2017). Thus, as a general matter an aircraft can no longer be exchanged for another aircraft without recognition of gain to both aircraft owners in the exchange.

The elimination of Section 1031 exchanges for non-real property is ameliorated by the new provision discussed above permitting immediate expensing of as much as 100 percent of the cost of certain tangible property. Still, the phase down of these bonus depreciation provisions will generally mean that over time transactions may require significant planning to minimize tax impact.

Conclusion

This article is only a brief summary of certain provisions implemented or revised by the Act. Future guidance will hopefully clarify various aspects of the Act and its impact on state or local taxation. One thing is clear, however; the Act represents a major overhaul of the U.S. federal tax system.

Click below to download the complete newsletter featuring this article.

1 All section references are to sections of the Internal Revenue Code of 1986, as amended (Code).

2 The 100 percent immediate expensing election applies to all assets in a given depreciation class, not on an asset-by-asset basis. That is, cherry-picking of assets in a given depreciation class is not permitted.

3 Qualified business use for this purpose is, with certain exceptions, use by the taxpayer in a trade or business of such taxpayer. Section 280F(d)(6). Also, property is predominantly used for this purpose if the percentage of the use of such property during a given taxable year in a qualified business use exceeds 50 percent. Section 280F(b)(3).

4 The determination of whether an activity is a hobby generally requires a facts and circumstances analysis, applying various factors. However, there is a presumption that if “gross income derived from an activity for 3 or more of the taxable years in the period of 5 consecutive taxable years which ends with the taxable year exceeds the deductions attributable to such activity,” then such activity is not a hobby. Sec. 183(c).

5 Office of Chief Counsel, I.R.S., Chief Counsel Advice No. 201210026 (Mar. 9, 2012).

6 A “disqualified lease” for this purpose is a lease from a provider of management services (or a related person) if such lease is for a term of 31 days or less.

7 Flights under the fractional ownership aircraft program are not subject to FET if such flights are subject to an additional fuel surtax of 14.1 cents per gallon under Section 4043.

Professionals

-

Services