Put Option Agreements in Aviation Financing

Introduction

In a typical aircraft financing involving a People’s Republic of China (the “PRC”) parent company (the “PRC Parent”), (i) the PRC Parent (which is considered to be “onshore” for purposes of this article) (A) forms a special purpose company (“SPC”) outside of the PRC (which is considered to be “offshore” for purposes of this article) and (B) owns, directly or indirectly, the shares in the SPC; (ii) the finance parties (which are considered to be “offshore” for purposes of this article) make loan(s) to the SPC; (iii) the SPC is (A) the borrower under the financing and (B) the lessor under the leasing arrangement; (iv) the SPC grants security over the aircraft and the leasing arrangement in favour of the finance parties; (v) the SPC leases the aircraft to the airline(s); and (vi) the PRC Parent provides a put option agreement or a guarantee in favour of the finance parties.

In the context of aviation finance, the put option agreement is a keepwell arrangement which allows the security trustee (the “Security Trustee”) on behalf of the finance parties to require the SPC, as borrower (the “Borrower”), to sell and the onshore PRC Parent to purchase a financed aircraft (the “Aircraft”) following a loan event of default. The sale proceeds are then applied towards the outstanding loan.

This article will briefly summarise, from an aviation finance perspective, the origins and structure of the keepwell put option agreement and common provisions found therein, as well as a recent development in case law.

Origins and Common Structures Involving Keepwell Put Option Agreements

In a traditional secured asset financing involving a ring-fenced special purpose vehicle borrower, lenders commonly require parent companies to provide guarantees in respect of the obligations of the borrower under the financing. Due to historical neibaowaidai restrictions on repatriation of funds under the Administration of Foreign Exchange of the People’s Republic of China (“SAFE”) regulatory framework in the PRC, PRC lessors faced difficulties providing such parent guarantees.

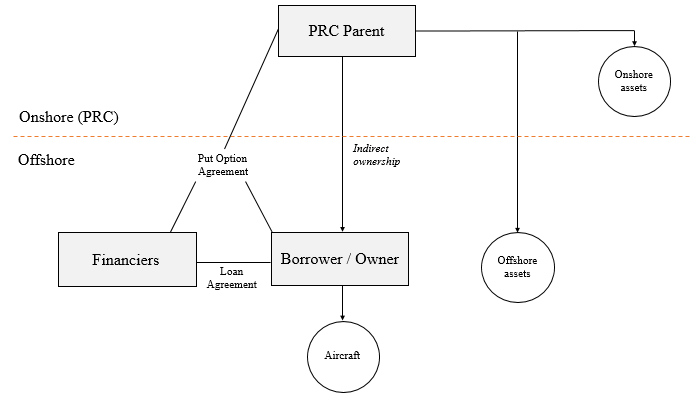

The lack of credit support by the PRC Parent under the parent guarantees presented difficult challenges for lenders involved in these aircraft financings. Enter keepwell put option agreements. Using the put option structure with the pretext of purchasing the Aircraft, the PRC Parent has an ostensibly legitimate reason to transfer funds to an offshore borrower, and such funds can in turn be used to satisfy outstanding loans owed under the financing. Under a purchase option structure, the PRC Parent provides the liquidity support and undertakings to support the offshore aircraft financing by entering into the put option agreement. A typical structure is illustrated below for reference.

While the neibaowaidai repatriation restrictions have since been relaxed, put option agreements continue to be popular and widely accepted in the aviation market due to SAFE approval or registration requirements for parent guarantees.

A word of caution - it is important to bear in mind that in an enforcement scenario, a put option agreement will require a financier to prove breach of an undertaking by the PRC Parent while a PRC Parent guarantee would be a debt claim. The latter is typically understood to be much easier to establish in court.

Common Elements of a Keepwell Put Option Agreement

Keepwell agreements typically contain the following elements, the principal one being the put option documenting mechanics for the sale of the Aircraft, and the finance parties’ corresponding recovery of outstanding debt:

Sale of Aircraft (the put option): Following a loan event of default, the Security Trustee can notify the PRC Parent that it is exercising its put option in respect of the Aircraft. The PRC Parent will then typically be given a certain grace period of thirty (30) to sixty (60) days to purchase (or procure purchase of) the Aircraft (the “Sale Period”). Similar to conventional sales, the PRC Parent is required, in fairly short order, to pay a purchase price deposit (the “Deposit”) to secure its purchase obligation. The Deposit will typically be an estimate of the outstanding amount due under the loan (the “Secured Obligations”) calculated on such date. Upon the expiry of the Sale Period, the Aircraft will be sold for an amount equal to the Secured Obligations owed by the Borrower under the financing as of such date. Upon consummation of the sale and purchase pursuant to the put option agreement, the sale proceeds are deposited to the Borrower’s account charged in favour of the Security Trustee, and the Deposit returned to the PRC Parent. If the Aircraft is not sold within the Sale Period, the Security Trustee may apply the Deposit in satisfaction of the Secured Obligations and if the Deposit is insufficient, file a claim against the PRC Parent for the remainder as damages for breach of contract.

Covenants and representations: Covenants and representations required from the PRC Parent typically fall into the following categories:

(i) Ownership:

The PRC Parent is typically required to maintain 100% direct or indirect ownership of the Borrower. There may also be restrictions on the ownership of the PRC Parent itself.

(ii) Financial:

Similar to guarantees, the PRC Parent typically has to satisfy certain financial requirements in relation to its net worth as well as liquidity, and in connection with this, regularly provide updated audited financial statements. As an added precaution, the PRC Parent may also be required to covenant that it will ascertain the Borrower has sufficient funds to satisfy its Secured Obligations (while also being clear that this covenant is not a guarantee).

(iii) Regulatory:

Specific PRC approvals and authorisations pertaining to SAFE classification and compliance with foreign exchange requirements are usually detailed in the Put Option Agreement. Aside from the standard sanctions and anti-money laundering requirements, recent U.S. trade regulations designed to control the export of certain U.S. products and technologies to certain end users (including some in the PRC) have also led to inclusion of export control covenants.

The above are in addition to the usual suite of legal representations and undertakings pertaining to authorization, due execution, valid and binding obligations, etc. which are typically also covered in legal opinions.

Jurisdiction and governing law: While put option agreements may be governed by PRC law, parties tend to prefer to use English (or Hong Kong) law as the assessment of damages under common law tends to be clearer. Additionally, this reduces the risk of re-characterisation by PRC courts. Further, put option agreements commonly include and are subject to Hong Kong arbitration provisions. Enforcing Hong Kong arbitration awards or judgements in the PRC tend to be (relatively) easier than those of other jurisdictions due to the bilateral Arrangement Concerning Mutual Enforcement of Arbitral Awards between the PRC and Hong Kong (as supplemented in November 2020) and the Arrangement on Reciprocal Recognition and Enforcement of Judgments in Civil and Commercial Matters by the Courts of the Mainland and of the Hong Kong Special Administrative Region. Accordingly, Hong Kong arbitration or courts tend to be the dispute resolution mechanism of choice.

Recent Cases

There have been two recent PRC cases in relation to keepwell agreements. For completeness, while these do not contain a keepwell put option, these are understood to apply to keepwell agreements in general as these cases essentially involved a PRC Parent undertaking to provide financial support to the indebted subsidiary and should be informative for keepwell put option agreements commonly used for aviation financings.

Peking University Founder Group Company (“PUFG”):

On 19 August 2020, the bankruptcy administrator of PUFG rejected claims submitted by BNY Mellon as trustee under the keepwell deeds provided by PUFG in support of bonds issued by its subsidiaries. Prior to the rejection, administrators indicated they might require “a valid judgment or arbitral award” confirming PUFG’s liability under the keepwell deeds in order to make their determination. While BNY Mellon was provided the opportunity to appeal the relevant PRC court (and hopefully obtain such ‘valid judgment’), due to difficulties from a timing and cost perspective, BNY Mellon did not take this route. It will be of interest to see whether future administrators choose to take a similar approach of essentially kicking the can down the road.

CEFC Shanghai International Group Ltd. (“CEFC”):

In 2017, CEFC granted a keepwell deed in support of notes issued by its BVI subsidiary. The keepwell deed was governed by English law with submission to Hong Kong courts. Following a default by the BVI subsidiary on the notes, the noteholders filed an action in the Hong Kong courts for breach by CEFC of the keepwell deed, and in the absence of defence by CEFC, were awarded a default judgment in their favour. In May 2019, the noteholders applied to the Shanghai Financial Court for recognition and enforcement of the Hong Kong judgment, and in November 2019 following the bankruptcy of CEFC, with the administrators in respect of the keepwell deed. In November 2020, the Shanghai Financial Court issued a decision granting recognition and enforcement of the Hong Kong judgment in the PRC. This decision was made on a purely procedural basis, i.e., the validity, nature and effect of the keepwell deed as a matter of PRC law was not within scope. This could provide a useful avenue of enforcement for creditors going forward and highlights the importance of the selection of dispute resolution forum and governing law.

Conclusion

In the absence of any better alternative given continuing regulatory restrictions on PRC Parents granting guarantees, we expect the use of put option agreements (in lieu of a guarantee) to continue to be the accepted market practice and standard involving PRC leasing companies. Given recent case law, governing law and jurisdiction clauses may, however, be subject to added scrutiny and creditors may want to be quicker to act in a pre-insolvency enforcement scenario.

Vedder Thinking | Articles Put Option Agreements in Aviation Financing

Article

August 11, 2021

Introduction

In a typical aircraft financing involving a People’s Republic of China (the “PRC”) parent company (the “PRC Parent”), (i) the PRC Parent (which is considered to be “onshore” for purposes of this article) (A) forms a special purpose company (“SPC”) outside of the PRC (which is considered to be “offshore” for purposes of this article) and (B) owns, directly or indirectly, the shares in the SPC; (ii) the finance parties (which are considered to be “offshore” for purposes of this article) make loan(s) to the SPC; (iii) the SPC is (A) the borrower under the financing and (B) the lessor under the leasing arrangement; (iv) the SPC grants security over the aircraft and the leasing arrangement in favour of the finance parties; (v) the SPC leases the aircraft to the airline(s); and (vi) the PRC Parent provides a put option agreement or a guarantee in favour of the finance parties.

In the context of aviation finance, the put option agreement is a keepwell arrangement which allows the security trustee (the “Security Trustee”) on behalf of the finance parties to require the SPC, as borrower (the “Borrower”), to sell and the onshore PRC Parent to purchase a financed aircraft (the “Aircraft”) following a loan event of default. The sale proceeds are then applied towards the outstanding loan.

This article will briefly summarise, from an aviation finance perspective, the origins and structure of the keepwell put option agreement and common provisions found therein, as well as a recent development in case law.

Origins and Common Structures Involving Keepwell Put Option Agreements

In a traditional secured asset financing involving a ring-fenced special purpose vehicle borrower, lenders commonly require parent companies to provide guarantees in respect of the obligations of the borrower under the financing. Due to historical neibaowaidai restrictions on repatriation of funds under the Administration of Foreign Exchange of the People’s Republic of China (“SAFE”) regulatory framework in the PRC, PRC lessors faced difficulties providing such parent guarantees.

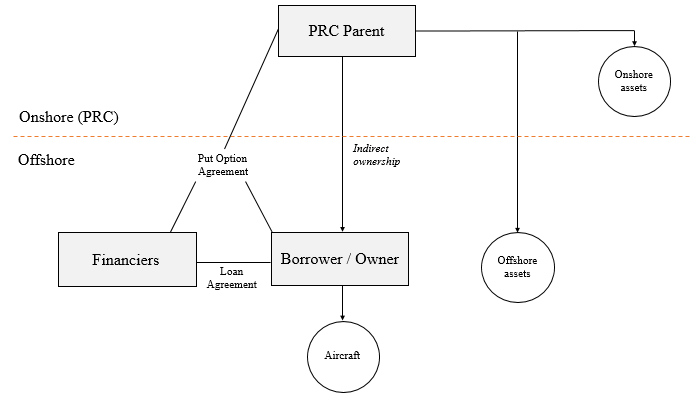

The lack of credit support by the PRC Parent under the parent guarantees presented difficult challenges for lenders involved in these aircraft financings. Enter keepwell put option agreements. Using the put option structure with the pretext of purchasing the Aircraft, the PRC Parent has an ostensibly legitimate reason to transfer funds to an offshore borrower, and such funds can in turn be used to satisfy outstanding loans owed under the financing. Under a purchase option structure, the PRC Parent provides the liquidity support and undertakings to support the offshore aircraft financing by entering into the put option agreement. A typical structure is illustrated below for reference.

While the neibaowaidai repatriation restrictions have since been relaxed, put option agreements continue to be popular and widely accepted in the aviation market due to SAFE approval or registration requirements for parent guarantees.

A word of caution - it is important to bear in mind that in an enforcement scenario, a put option agreement will require a financier to prove breach of an undertaking by the PRC Parent while a PRC Parent guarantee would be a debt claim. The latter is typically understood to be much easier to establish in court.

Common Elements of a Keepwell Put Option Agreement

Keepwell agreements typically contain the following elements, the principal one being the put option documenting mechanics for the sale of the Aircraft, and the finance parties’ corresponding recovery of outstanding debt:

Sale of Aircraft (the put option): Following a loan event of default, the Security Trustee can notify the PRC Parent that it is exercising its put option in respect of the Aircraft. The PRC Parent will then typically be given a certain grace period of thirty (30) to sixty (60) days to purchase (or procure purchase of) the Aircraft (the “Sale Period”). Similar to conventional sales, the PRC Parent is required, in fairly short order, to pay a purchase price deposit (the “Deposit”) to secure its purchase obligation. The Deposit will typically be an estimate of the outstanding amount due under the loan (the “Secured Obligations”) calculated on such date. Upon the expiry of the Sale Period, the Aircraft will be sold for an amount equal to the Secured Obligations owed by the Borrower under the financing as of such date. Upon consummation of the sale and purchase pursuant to the put option agreement, the sale proceeds are deposited to the Borrower’s account charged in favour of the Security Trustee, and the Deposit returned to the PRC Parent. If the Aircraft is not sold within the Sale Period, the Security Trustee may apply the Deposit in satisfaction of the Secured Obligations and if the Deposit is insufficient, file a claim against the PRC Parent for the remainder as damages for breach of contract.

Covenants and representations: Covenants and representations required from the PRC Parent typically fall into the following categories:

(i) Ownership:

The PRC Parent is typically required to maintain 100% direct or indirect ownership of the Borrower. There may also be restrictions on the ownership of the PRC Parent itself.

(ii) Financial:

Similar to guarantees, the PRC Parent typically has to satisfy certain financial requirements in relation to its net worth as well as liquidity, and in connection with this, regularly provide updated audited financial statements. As an added precaution, the PRC Parent may also be required to covenant that it will ascertain the Borrower has sufficient funds to satisfy its Secured Obligations (while also being clear that this covenant is not a guarantee).

(iii) Regulatory:

Specific PRC approvals and authorisations pertaining to SAFE classification and compliance with foreign exchange requirements are usually detailed in the Put Option Agreement. Aside from the standard sanctions and anti-money laundering requirements, recent U.S. trade regulations designed to control the export of certain U.S. products and technologies to certain end users (including some in the PRC) have also led to inclusion of export control covenants.

The above are in addition to the usual suite of legal representations and undertakings pertaining to authorization, due execution, valid and binding obligations, etc. which are typically also covered in legal opinions.

Jurisdiction and governing law: While put option agreements may be governed by PRC law, parties tend to prefer to use English (or Hong Kong) law as the assessment of damages under common law tends to be clearer. Additionally, this reduces the risk of re-characterisation by PRC courts. Further, put option agreements commonly include and are subject to Hong Kong arbitration provisions. Enforcing Hong Kong arbitration awards or judgements in the PRC tend to be (relatively) easier than those of other jurisdictions due to the bilateral Arrangement Concerning Mutual Enforcement of Arbitral Awards between the PRC and Hong Kong (as supplemented in November 2020) and the Arrangement on Reciprocal Recognition and Enforcement of Judgments in Civil and Commercial Matters by the Courts of the Mainland and of the Hong Kong Special Administrative Region. Accordingly, Hong Kong arbitration or courts tend to be the dispute resolution mechanism of choice.

Recent Cases

There have been two recent PRC cases in relation to keepwell agreements. For completeness, while these do not contain a keepwell put option, these are understood to apply to keepwell agreements in general as these cases essentially involved a PRC Parent undertaking to provide financial support to the indebted subsidiary and should be informative for keepwell put option agreements commonly used for aviation financings.

Peking University Founder Group Company (“PUFG”):

On 19 August 2020, the bankruptcy administrator of PUFG rejected claims submitted by BNY Mellon as trustee under the keepwell deeds provided by PUFG in support of bonds issued by its subsidiaries. Prior to the rejection, administrators indicated they might require “a valid judgment or arbitral award” confirming PUFG’s liability under the keepwell deeds in order to make their determination. While BNY Mellon was provided the opportunity to appeal the relevant PRC court (and hopefully obtain such ‘valid judgment’), due to difficulties from a timing and cost perspective, BNY Mellon did not take this route. It will be of interest to see whether future administrators choose to take a similar approach of essentially kicking the can down the road.

CEFC Shanghai International Group Ltd. (“CEFC”):

In 2017, CEFC granted a keepwell deed in support of notes issued by its BVI subsidiary. The keepwell deed was governed by English law with submission to Hong Kong courts. Following a default by the BVI subsidiary on the notes, the noteholders filed an action in the Hong Kong courts for breach by CEFC of the keepwell deed, and in the absence of defence by CEFC, were awarded a default judgment in their favour. In May 2019, the noteholders applied to the Shanghai Financial Court for recognition and enforcement of the Hong Kong judgment, and in November 2019 following the bankruptcy of CEFC, with the administrators in respect of the keepwell deed. In November 2020, the Shanghai Financial Court issued a decision granting recognition and enforcement of the Hong Kong judgment in the PRC. This decision was made on a purely procedural basis, i.e., the validity, nature and effect of the keepwell deed as a matter of PRC law was not within scope. This could provide a useful avenue of enforcement for creditors going forward and highlights the importance of the selection of dispute resolution forum and governing law.

Conclusion

In the absence of any better alternative given continuing regulatory restrictions on PRC Parents granting guarantees, we expect the use of put option agreements (in lieu of a guarantee) to continue to be the accepted market practice and standard involving PRC leasing companies. Given recent case law, governing law and jurisdiction clauses may, however, be subject to added scrutiny and creditors may want to be quicker to act in a pre-insolvency enforcement scenario.

-

Services