Executive Summary Analysis of Updated Main Street Lending Program

Download PDF

On April 9, 2020, the Board of Governors of the Federal Reserve System (the “Federal Reserve”) released term sheets outlining the Main Street Lending Program under the Coronavirus Economic Stabilization Act (the “CARES Act”): (1) the Main Street New Loan Facility (“New Loans”), and (2) the Main Street Expanded Loan Facility (“Expanded Loans”). On April 30, 2020, the Federal Reserve released updated term sheets for New Loans and Expanded Loans; added a third facility, the Main Street Priority Loan Facility (“Priority Loans”); and released Frequently Asked Questions (“FAQ”) about the Main Street Lending Program.

These programs are aimed at paving the way for increased lending to small and medium-sized businesses. Under these facilities, the Federal Reserve Bank of Boston will commit to lend to a Main Street Special Purpose Vehicle (“SPV”), which in turn will purchase 85% participations in Priority Loans and 95% participations in New Loans and Expanded Loans. Eligible lenders would hold 15% of the exposure on Priority Loans and 5% of the exposure of New Loans and Expanded Loans. The combined commitment of the Federal Reserve and Treasury Department to the SPV will be up to $600 billion.

The April 30 updates now permit larger businesses to participate in the Main Street Lending Program while relaxing minimum amounts to help more small businesses (which we believe is in reaction to so many businesses being shut out of the SBA Paycheck Protection Program under the CARES Act and the expanded duration of the COVID-19 crisis). Businesses with up to 15,000 employees or $5 billion in annual revenue in 2019 are now eligible, up from earlier limits of 10,000 employees and $2.5 billion in revenue. The minimum loan size has been reduced to $500,000 from $1 million.

While the Federal Reserve had initially unveiled two different loan facilities, one for new debt (New Loans) and one for existing loans (Expanded Loans), leaving banks with a 5% stake in the loans, the April 30 release included a third option for companies with more leverage. Under that Priority Loan Facility, banks will have to maintain a larger 15% stake in the debt sold to the Federal Reserve’s SPV. The Priority Loans also can be used as part of a debt refinancing package to enable more leveraged firms to restart with new lenders.

Other notable changes in the April 30 updates include: (i) clarification that EBITDA will be calculated using the adjusted EBITDA methodology employed in existing loan documents; (ii) pricing for all of the loans is LIBOR plus 300 basis points; (iii) all loan payments can be deferred for one year and must be paid in four years with amortization varying depending on which loan is utilized; (iv) clarification that the loans may be secured or unsecured, and where the priorities fall in relation to existing loans as described in more detail below; (v) important clarifications were made to allow pass-through entities like S corporations and limited liability companies to pay tax distributions; and (vi) SBA affiliation rules apply (as modified for the Main Street Lending Program parameters) so that a borrower and all of its affiliates must have less than 15,000 employees or 2019 annual revenues of less than $5 billion.

Unfortunately, even after the April 30 release of new term sheets and an FAQ, no information is yet available on which lenders are participating in the program, how to apply and the launch date. It is clear that the lenders will have a key role in determining underwriting standards and borrower eligibility.

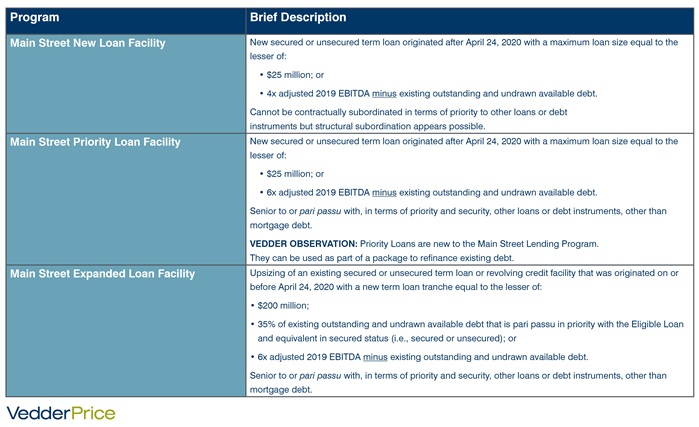

This summary briefly describes the lending programs and compares them in an easy-to-digest chart. We note that this is current as of April 30, 2020, and adjustments to these programs will be made in the future.

Key Updates to Main Street Lending Program

1. Priority Loan Facility: The Priority Loan Facility is added to the Main Street Lending Program, which facility will purchase participations in newly originated term loans based on 6x adjusted 2019 EBITDA (i.e., looser than New Loan Facility), with an 85% (rather than 95%) participation to the SPV. Priority Loans can be used to refinance existing debt.

2. Loan Sizing:

- Maximum loan sizes are expanded as a result of being based on (i) “adjusted EBITDA,” and (ii) “existing outstanding and undrawn available debt,” with further guidance provided on how to calculate.

- Fed and Treasury will evaluate feasibility of adjusting loan eligibility metrics for asset-based borrowers.

- Maximum loan sizes are expanded to range from $500,000 to $200 million, with separate minimums and caps for each loan facility.

3. Priority: Secured and unsecured term loans are included, but subject to priority rules:

- New Loan Facility: Cannot be contractually subordinated in terms of priority to other loans or debt instruments.

- Priority Loan Facility: Senior to or pari passu with, in terms of priority and security, other loans or debt instruments, other than mortgage debt.

- Expanded Loan Facility: Senior to or pari passu with, in terms of priority and security, other loans or debt instruments, other than mortgage debt.

4. Eligible Borrowers:

- Eligibility expanded to include businesses with either (i) 15,000 employees or fewer, or (ii) $5 billion or less of 2019 annual revenues.

- Affiliations rules are imposed, which will eliminate many private equity-backed businesses and public companies from consideration.

- Certain categories of businesses are made ineligible.

- Financial assessments of each borrower will be conducted by lenders.

5. Eligible Lenders:

- U.S. branches or agencies of foreign banks are included.

- Alternative lenders continue to be excluded, but Fed is considering options to expand list of Eligible Lenders.

- If the loan underlying an ELF upsized tranche is part of a syndicated credit facility, the Eligible Lender must be one of the lenders that holds an interest in the underlying loan.

6. Interest Rate:

- LIBOR-based rather than SOFR-based.

- All facilities have same rate, notwithstanding differing leverage profiles and amortization schedules.

7. Amortization: Post year-1 amortization schedules are provided for each loan facility, which are in meaningful amounts.

8. Tax Distributions: Permitted to be made by flow-through vehicles such as limited liability companies and S Corporations.

9. Assignability: Eligible Lenders are restricted from assigning Eligible Loans and upsized tranches as a result of imposition of hold periods.

10. Repayment/Commitment Reductions: Certain repayments and commitment reductions of other debt are permitted, including in the case of the Priority Loan Facility, refinancing of existing debt not held by the Eligible Lender.

Vedder Thinking | Articles Executive Summary Analysis of Updated Main Street Lending Program

Article

May 3, 2020

Download PDF

On April 9, 2020, the Board of Governors of the Federal Reserve System (the “Federal Reserve”) released term sheets outlining the Main Street Lending Program under the Coronavirus Economic Stabilization Act (the “CARES Act”): (1) the Main Street New Loan Facility (“New Loans”), and (2) the Main Street Expanded Loan Facility (“Expanded Loans”). On April 30, 2020, the Federal Reserve released updated term sheets for New Loans and Expanded Loans; added a third facility, the Main Street Priority Loan Facility (“Priority Loans”); and released Frequently Asked Questions (“FAQ”) about the Main Street Lending Program.

These programs are aimed at paving the way for increased lending to small and medium-sized businesses. Under these facilities, the Federal Reserve Bank of Boston will commit to lend to a Main Street Special Purpose Vehicle (“SPV”), which in turn will purchase 85% participations in Priority Loans and 95% participations in New Loans and Expanded Loans. Eligible lenders would hold 15% of the exposure on Priority Loans and 5% of the exposure of New Loans and Expanded Loans. The combined commitment of the Federal Reserve and Treasury Department to the SPV will be up to $600 billion.

The April 30 updates now permit larger businesses to participate in the Main Street Lending Program while relaxing minimum amounts to help more small businesses (which we believe is in reaction to so many businesses being shut out of the SBA Paycheck Protection Program under the CARES Act and the expanded duration of the COVID-19 crisis). Businesses with up to 15,000 employees or $5 billion in annual revenue in 2019 are now eligible, up from earlier limits of 10,000 employees and $2.5 billion in revenue. The minimum loan size has been reduced to $500,000 from $1 million.

While the Federal Reserve had initially unveiled two different loan facilities, one for new debt (New Loans) and one for existing loans (Expanded Loans), leaving banks with a 5% stake in the loans, the April 30 release included a third option for companies with more leverage. Under that Priority Loan Facility, banks will have to maintain a larger 15% stake in the debt sold to the Federal Reserve’s SPV. The Priority Loans also can be used as part of a debt refinancing package to enable more leveraged firms to restart with new lenders.

Other notable changes in the April 30 updates include: (i) clarification that EBITDA will be calculated using the adjusted EBITDA methodology employed in existing loan documents; (ii) pricing for all of the loans is LIBOR plus 300 basis points; (iii) all loan payments can be deferred for one year and must be paid in four years with amortization varying depending on which loan is utilized; (iv) clarification that the loans may be secured or unsecured, and where the priorities fall in relation to existing loans as described in more detail below; (v) important clarifications were made to allow pass-through entities like S corporations and limited liability companies to pay tax distributions; and (vi) SBA affiliation rules apply (as modified for the Main Street Lending Program parameters) so that a borrower and all of its affiliates must have less than 15,000 employees or 2019 annual revenues of less than $5 billion.

Unfortunately, even after the April 30 release of new term sheets and an FAQ, no information is yet available on which lenders are participating in the program, how to apply and the launch date. It is clear that the lenders will have a key role in determining underwriting standards and borrower eligibility.

This summary briefly describes the lending programs and compares them in an easy-to-digest chart. We note that this is current as of April 30, 2020, and adjustments to these programs will be made in the future.

Key Updates to Main Street Lending Program

1. Priority Loan Facility: The Priority Loan Facility is added to the Main Street Lending Program, which facility will purchase participations in newly originated term loans based on 6x adjusted 2019 EBITDA (i.e., looser than New Loan Facility), with an 85% (rather than 95%) participation to the SPV. Priority Loans can be used to refinance existing debt.

2. Loan Sizing:

- Maximum loan sizes are expanded as a result of being based on (i) “adjusted EBITDA,” and (ii) “existing outstanding and undrawn available debt,” with further guidance provided on how to calculate.

- Fed and Treasury will evaluate feasibility of adjusting loan eligibility metrics for asset-based borrowers.

- Maximum loan sizes are expanded to range from $500,000 to $200 million, with separate minimums and caps for each loan facility.

3. Priority: Secured and unsecured term loans are included, but subject to priority rules:

- New Loan Facility: Cannot be contractually subordinated in terms of priority to other loans or debt instruments.

- Priority Loan Facility: Senior to or pari passu with, in terms of priority and security, other loans or debt instruments, other than mortgage debt.

- Expanded Loan Facility: Senior to or pari passu with, in terms of priority and security, other loans or debt instruments, other than mortgage debt.

4. Eligible Borrowers:

- Eligibility expanded to include businesses with either (i) 15,000 employees or fewer, or (ii) $5 billion or less of 2019 annual revenues.

- Affiliations rules are imposed, which will eliminate many private equity-backed businesses and public companies from consideration.

- Certain categories of businesses are made ineligible.

- Financial assessments of each borrower will be conducted by lenders.

5. Eligible Lenders:

- U.S. branches or agencies of foreign banks are included.

- Alternative lenders continue to be excluded, but Fed is considering options to expand list of Eligible Lenders.

- If the loan underlying an ELF upsized tranche is part of a syndicated credit facility, the Eligible Lender must be one of the lenders that holds an interest in the underlying loan.

6. Interest Rate:

- LIBOR-based rather than SOFR-based.

- All facilities have same rate, notwithstanding differing leverage profiles and amortization schedules.

7. Amortization: Post year-1 amortization schedules are provided for each loan facility, which are in meaningful amounts.

8. Tax Distributions: Permitted to be made by flow-through vehicles such as limited liability companies and S Corporations.

9. Assignability: Eligible Lenders are restricted from assigning Eligible Loans and upsized tranches as a result of imposition of hold periods.

10. Repayment/Commitment Reductions: Certain repayments and commitment reductions of other debt are permitted, including in the case of the Priority Loan Facility, refinancing of existing debt not held by the Eligible Lender.